DOMO Chemicals & the Belgium-China Investment Climate in 2024

DOMO Chemicals is a global leader in the production of engineering materials, specialising in sustainable polyamide solutions. The company is dedicated to innovating and developing products that enhance everyday life while making positive contributions to society and its stakeholders. The company operates in several industries, including the automotive sector, electrical & electronics and agriculture & fertilisers. Based in Belgium, DOMO Chemicals operates with a strong focus on environmental responsibility and community engagement. The Ghent-based chemical company is investing 14 million euros in an advanced polyamide factory in China, near Shanghai. With this investment of 14 million euros, the Belgian chemical company doubled its production capacity in China. According to Belgium Media, the investment is notable at a time when many companies in the chemical industry are scaling back their investments. However, after a more extensive look into recent data about investments from Belgium to China, and vice versa, provides a more complete overview of the background of these investments, and could explain the underlying mechanisms and reasons for this investment. However, a deeper examination of recent investment data between Belgium and China offers a more comprehensive understanding of the context and background behind these investments. This analysis sheds light on the underlying mechanisms and motivations driving this investment.

Investment climate Belgium to China

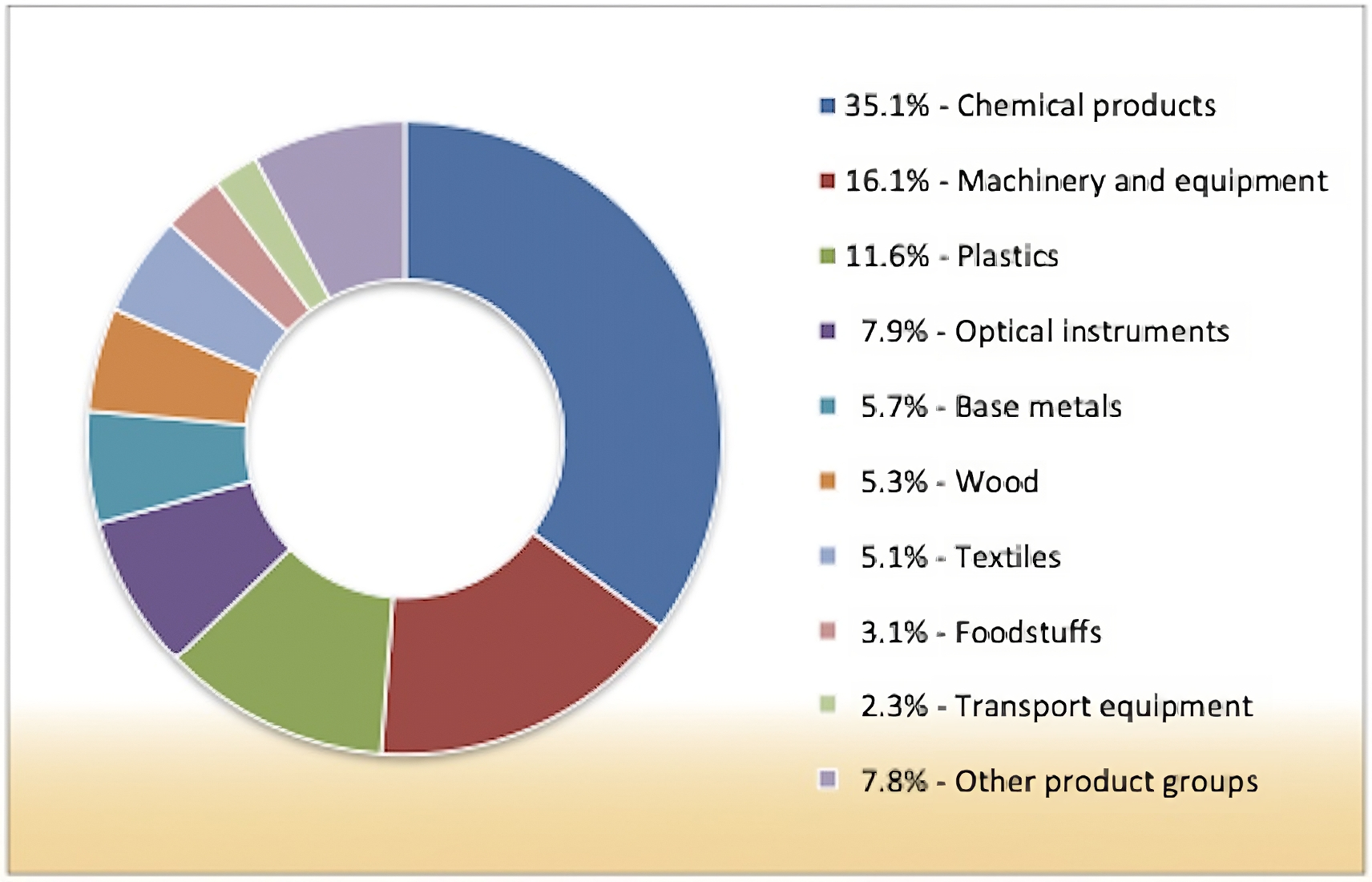

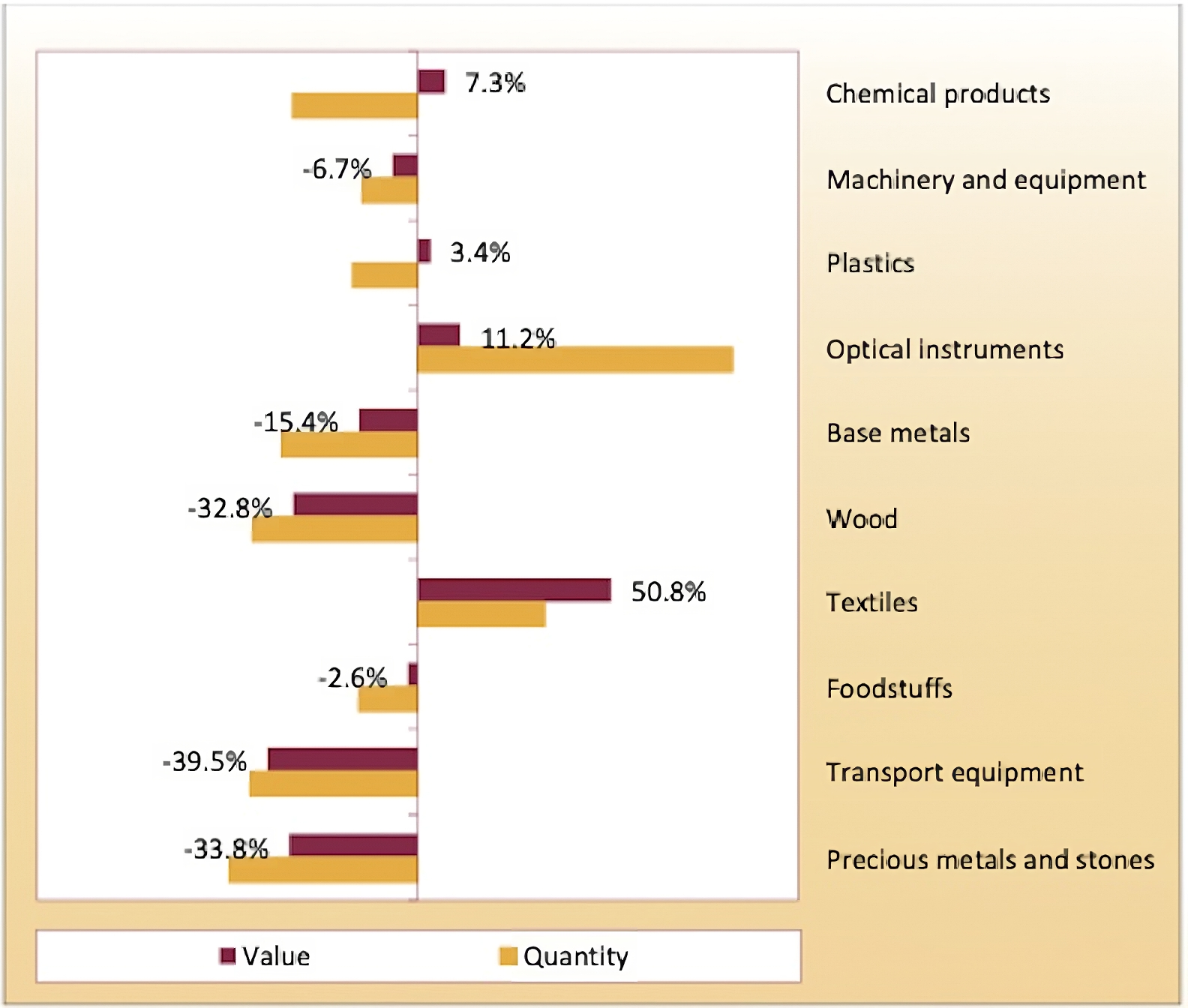

While Belgian media suggests a general economic downturn, a closer analysis of the data reveals that China's chemical market continues to grow. According to a study done by the Belgium Foreign Trade Agency, in 2022, chemical products were the top export category from Belgium to China, valued at just over €2.7 billion and accounting for 35.1% of Belgium's total exports. This category was primarily composed of 'medicaments for therapeutic or prophylactic purposes' and 'vaccines against SARS-related coronaviruses', making it the most significant contributor to the export data. Machinery and equipment were the second largest export category, approaching €1.3 billion and making up 16.1% of the total. Noteworthy items in this category included 'processors and controllers' and 'electric control bases', showcasing Belgium's strength in technological exports. Plastics took the third spot, with products like 'ethylene polymers', 'polypropylene', and 'polyamides in primary forms', totalling €903.4 million and representing 11.6% of exports. Other significant export categories to China included optical, precision, and medical instruments (€614.3 million, 7.9% of exports); base metals (€445.0 million, 5.7%); wood products (€412.1 million, 5.3%); and textiles (€393.1 million, 5.1%). Each of these groups played a substantial role in Belgian exports to China, each exceeding a 5.0% share. An overview of these export volumes for Belgium to China is shown in Figure 1. Furthermore, these chemical products led Belgian exports to China with a significant increase of 7.3% (€+185.8 million), driven mainly by increased exports of 'immunological products' and 'carbon', among other factors. While there was a decrease in the volume of imports in certain categories such as 'mineral or chemical fertilisers containing nitrogen, phosphorus, and potassium', it did not significantly affect the overall value of chemical exports. Plastics and optical, precision, and medical instruments also saw growth, with increases of 3.4% (€+29.6 million) and 11.2% (€+61.8 million) respectively. Textile exports experienced a remarkable surge of 50.8% (€+132.5 million), mainly due to the 'flax' subsection. An overview of the growth and decline rate of Belgium exports to China is shown in Figure 2.Despite these gains, the total value of Belgian exports to China decreased by 2.8% in 2022, aligning with Belgian media reports of an overall decline in exports. This overall decline was largely due to a significant reduction in transport equipment exports, highlighted by a 39.5% decrease (€-118.3 million) in the 'road tractors for semi-trailers' subsection. Among the top ten product groups, several witnessed declines in exports, ranging from 2.6% (foodstuffs) to 33.8% (precious stones and metals). The significant drop of €81.6 million in the latter category was primarily due to decreased exports of ‘diamonds'. Hence, chemical products remain to be a growing market, which allows for DOMO and other chemical companies to keep investing in the Chinese market, despite the overall decline.

Figure 1: Breakdown of Belgium exports to China by principal commodities (in %) - 2022

Source: Agentschap van Buitenlandse Handel (Belgium Foreign Trade Agency)

Figure 2: Variation of Exports to China by Principal Commodities (in value and quantity) - 2022/2021

Source: Agentschap van Buitenlandse Handel (Belgium Foreign Trade Agency)

Investment climate China to Belgium

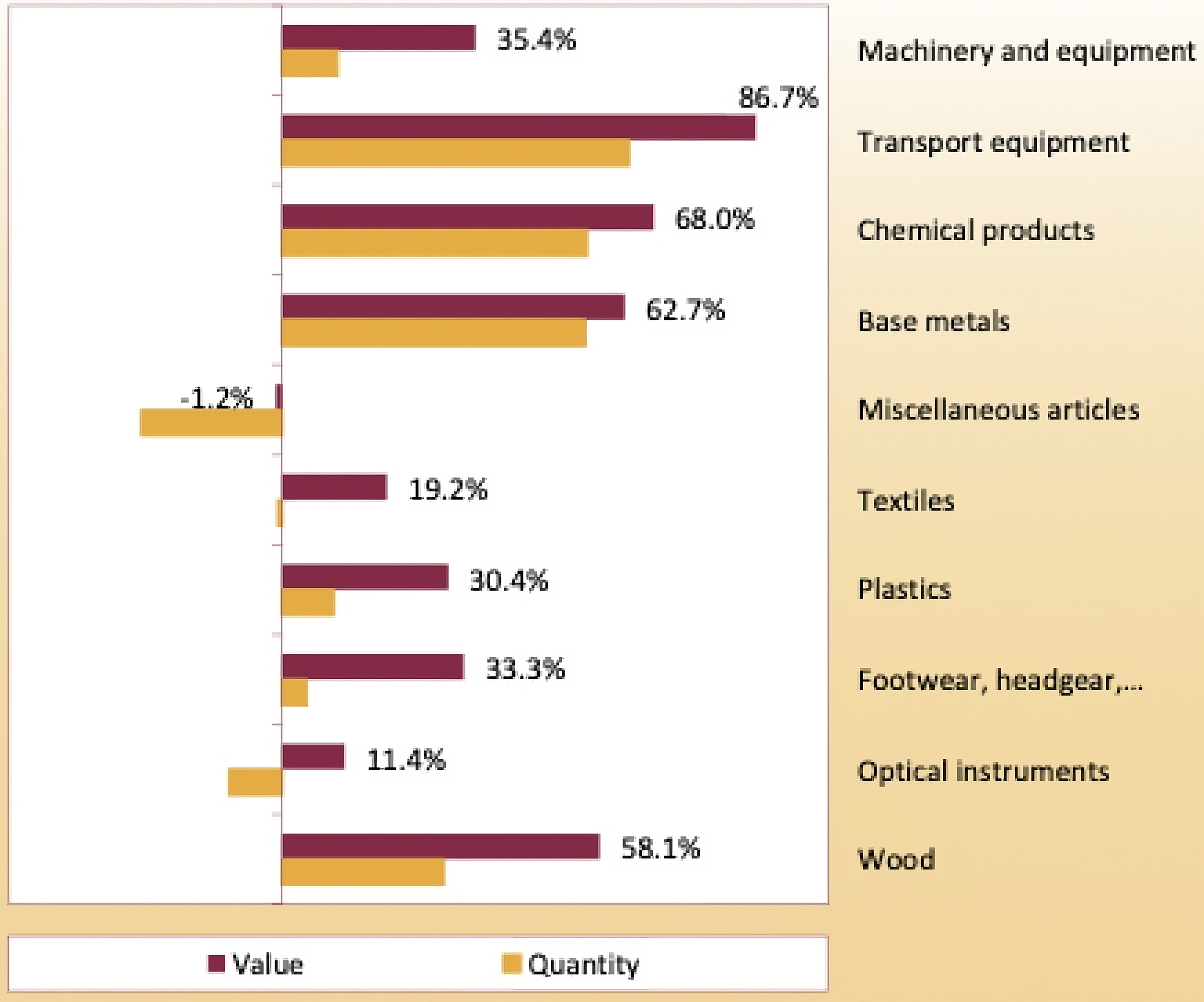

In 2022, machinery and equipment took the lead in Belgian imports from China, valued at nearly €10.7 billion according to a study done by Belgium Foreign Trade Agency. This category, making up 30.2% of total imports, primarily included 'lithium-ion accumulators', 'smartphones', and 'static converters’. Close behind, transport equipment imports, which included vehicles with electric and hybrid propulsion systems, reached almost €6.7 billion and accounted for 18.8% of the total. Chemical products were the third largest category, with imports worth approximately €3.7 billion. This group, comprising 'biodiesel', 'prepared binders for foundry molds', and 'medicaments for therapeutic or prophylactic uses', represented 10.4% of total imports. Additionally, several other product groups also made significant contributions to Belgian imports from China, each with a share of 5.0% or more: Base metals, with a value of €2.9 billion and an 8.1% share; Miscellaneous manufactured articles, valued at €2.6 billion and constituting a 7.5% share; Textiles, totalling €1.9 billion for a 5.3% share; Plastics, with imports valued at €1.8 billion, accounting for a 5.0% share. Figure 3 presents an overview of the data concerning the investment climate from China to Belgium. Moreover, these investments have increased significantly in the past couple of years, according to the same study. The collective rise in value across these product groups significantly contributed to the overall 42.6% increase in Belgian imports from China. Machinery and equipment topped the list of Belgian imports from China, registering a significant growth of 35.4% (€+2.8 billion). This increase was mainly due to a rise in imports of 'lithium-ion accumulators', 'smartphones', and 'photovoltaic cells assembled in modules or panels’. Transport equipment was the standout performer in terms of import growth, with its value skyrocketing by nearly €3.1 billion (86.7%). This jump was driven by an uptick in imports of 'vehicles with electric propulsion' and 'hybrid vehicles with internal combustion engines and electric motors’. Other major product groups also saw increases in their import values, ranging from 11.4% in optical, precision, and medical instruments to 68.0% in chemical products. The substantial €1.5 billion rise in chemical products was largely due to increased imports of 'biodiesel', 'aniline and salts', and 'diagnostic or laboratory reagents on backing’. An overview of these numbers is provided in Figure 4. The increasing investment from China to Belgium is significant for DOMO Chemicals, particularly as they invest in a new factory in China. This growing economic relationship can ease market access and improve supply chain integration, allowing DOMO to better penetrate the Chinese market and optimise production costs. Additionally, such investments can foster technology exchange and may offer financial incentives like tax breaks or grants. These benefits enhance DOMO's competitiveness in China, ensuring they remain a strong player in the global chemical industry amidst rising competitive pressures.

Figure 3: Breakdown of Belgium Imports from China by Principal Commodities (in %) - 2022

![]()

Source: Agentschap van Buitenlandse Handel (Belgium Foreign Trade Agency)

Figure 4: Variation of Imports from China by Principal Commodities (in Value and Quantity) - 2022/2021

Source: Agentschap van Buitenlandse Handel (Belgium Foreign Trade Agency)

DOMO increased investment in China

DOMO Chemicals has strategically ramped up its investments in China, a move that aligns with the broader trends seen in the global chemical market. In a recent interview, the CEO of DOMO, Yves Bonte, outlined the company's reasons for deepening its engagement in the Chinese market, despite a general pullback in international investments by other companies. Firstly, DOMO is following its European clients, who are increasingly investing in China. This is a response not only to the increased demand within China, but also to the significantly higher growth rates observed there—two to three times those in the EU. The Chinese market shows particular promise for technical plastics, a sector where DOMO has seen a 20% growth over the previous year. Moreover, DOMO's commitment to innovation allows it to stay competitive. Innovations include making EVs lighter and using more renewable energy sources. The company has been involved in the development of connectors for solar panels, water management, and pump systems, as well as garden equipment. For instance, they recently introduced a high-pressure cleaner gun made from 100% recycled polyamide. Looking ahead, DOMO has ambitious sustainability goals. Currently, 10% of their products use recycled materials; by 2030, they aim to increase this to 20%. Bonte highlighted the role of polyamide in the climate transition, notably its utility in reducing the weight of EVs. However, this increased investment in China seems to run counter to the prevailing government and EU policies, which generally aim to retain industry within the EU. Despite this, the CEO emphasised that while their core operations will remain in the EU—focused primarily on sustainability—the company needs to expand internationally to meet client demands. Additionally, Bonte called for a more coherent and simplified energy policy within the EU to maintain competitiveness and retain top engineering talent, underlining the need for policies that support the industry's evolving dynamics and global expansion strategies.

Thus, as DOMO Chemicals forges ahead with its strategic investment in a new polyamide factory in China, the company continues to demonstrate its commitment to innovation and sustainability, crucial for future success in the global market. This move not only positions DOMO at the forefront of the dynamic chemical industry but also aligns with its long-term goals of environmental responsibility and robust global presence. By embracing challenges and opportunities in China, DOMO is well-placed to continue making impactful contributions to society while delivering value to all stakeholders.

Source: Agentschap van Buitenlandse Handel (Belgium Foreign Trade Agency) & Knack.be

Editor: Lucy van Eck