Global Trade Amidst Declining Chinese Imports in 2023

In 2023, the overall value of goods imported from mainland China fell nearly 17 percent compared to 2022, marking the first decline since 2016. In 2023, a significant downturn in commodities such as rare earth and aluminum contributed to a 4.6% decrease in total exports, which amounted to $3.38 trillion. Among major trading partners, exports to the U.S. experienced the largest decrease, falling 13% compared to the previous year. Similarly, demand from the European Union (EU) and Southeast Asian nations also declined. Trade with Russia was a notable exception, in 2023, trade between China and Russia, measured in dollars, reached $240.1 billion, marking a 26.3% increase from the previous year, as reported by Reuters. Additionally, China's imports from Russia saw a 13% rise from 2022. Yet, China has maintained its status as the EU's largest trading partner, with trade volumes surpassing $783 billion in 2023. This equates to nearly $1.5 million in trade exchanges every minute.

Trade NL-China

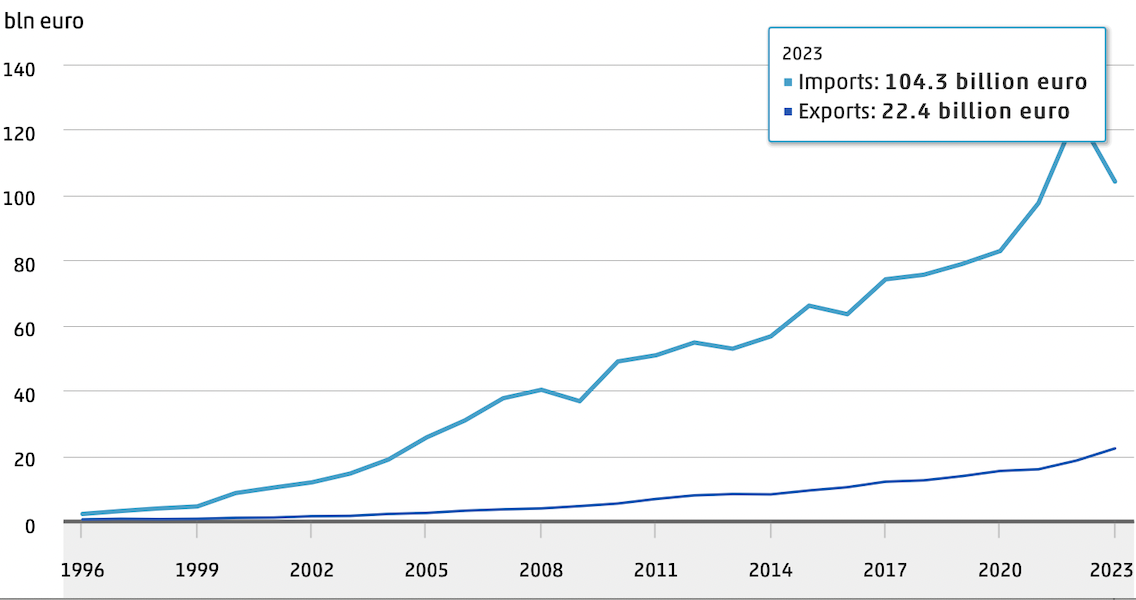

In 2023, the Netherlands imported goods worth 104.3 billion euros from mainland China, which is 20.8 billion euros less than the previous year. There was a decline in the value of both direct imports and goods in transit, aligning with a broader reduction in the volume of Chinese exports. Conversely, Dutch exports to mainland China increased by 20 percent in 2023. Consequently, the Netherlands' trade deficit with mainland China improved by 24.5 billion euros. Despite this improvement, the trade balance still remained negative, totalling 81.9 billion euros. This was reported by Statistics Netherlands (CBS) based on newly released data concerning trade statistics between the Netherlands and mainland China from the last seven years. The overall trend of trade in goods with mainland China is illustrated in Figure 1.

Figure 1: Trade in Goods with mainland China

Source: CBS Report 2024

Accessed through: https://www.cbs.nl/en-gb/news/2024/18/chinese-goods-imports-down-for-first-time-in-7-years

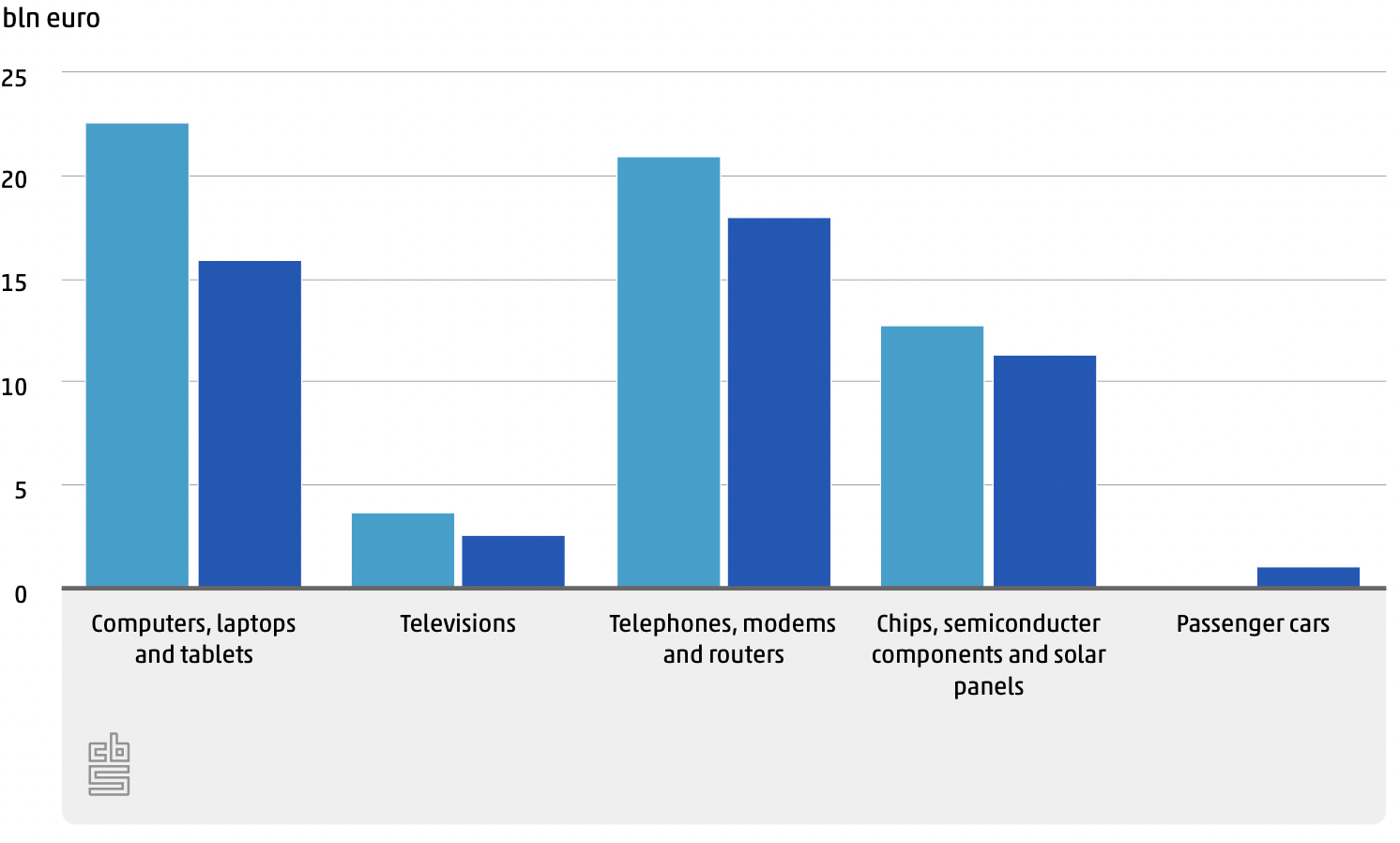

The reduction in import value spanned 71 percent of the Commodity Groups (Commodity group is another term for an SITC3 code. SITC stands for Standard International Trade Classification, and is a method of classifying commodities established by the United Nations) imported from mainland China, with the largest declines observed in four key categories: computers, laptops, and tablets; telephones, modems, and routers; chips, semiconductor components, and solar panels; and televisions. Collectively, these groups contributed to a decrease of 12.4 billion euros. The most significant drop occurred in the category of computers, laptops, and tablets, which saw a contraction of 6.7 billion euros—5.4 billion of which resulted from a reduced importation of laptops from mainland China (falling from 18.2 billion euros in 2022 to 12.7 billion euros in 2023). Additionally, routers and modems experienced a decline of 1.7 billion euros, and the import value of light-sensitive semiconductors from mainland China also fell by 1.1 billion euros. The decreased import value of commodity groups in 2022 and 2023 is shown in Figure 2.

Figure 2: Import value of commodity groups from mainland China

Source: CBS Report 2024.

Accessed through: https://www.cbs.nl/en-gb/news/2024/18/chinese-goods-imports-down-for-first-time-in-7-years

In 2023, over 43 percent of imported computers, laptops, and tablets originated from mainland China, down from 57 percent the previous year. However, the import value of similar goods from Taiwan tripled compared to the previous year. The import value from Taiwan increased from 2.2 billion euros in 2022 to 6.7 billion euros in 2023, boosting Taiwan’s market share from 5.5 percent to 18.4 percent. This made Taiwan the second largest supplier in the category of computers, laptops, and tablets, with an increase in import volume of 290 percent from the previous year.

Future perspectives

The economic interdependence between China and the EU is a testament to the benefits they have gained and can continue to gain from cooperation and healthy competition, rather than through adversarial relations. The global supply chains illustrate the reciprocal nature of the China-EU relationship and emphasise their strategic interdependence, which is pivotal for maintaining global economic stability. China’s capacity as a manufacturing hub pairs well with the EU’s expertise in sectors such as aerospace, industrial software, laser technology, and semiconductors, fostering a mutually beneficial partnership essential for the smooth functioning of global markets. For instance, China's substantial production of rare earth elements is vital for the EU’s manufacture of high-tech products such as smartphones, electric vehicles, and advanced computing systems. These materials are critical for the performance and efficiency of these technologies, underscoring China’s key role in the global technology supply chain.

Conclusion

The shifting dynamics of international trade in 2023, highlighted by the significant changes in trade volumes and the alteration of key relationships, have profound implications for the future of global commerce. The decline in mainland Chinese imports into European markets, particularly in high-tech and industrial goods, signals a critical transition in supply chain dependencies and consumer market behaviors. This, coupled with the resilience of China's trade relations with Russia, showcases the adaptability and strategic recalibration of China's global trade tactics. As we look to the future, several factors will likely shape the continued evolution of international trade relations. The increase in Dutch exports to mainland China and the rising prominence of Taiwan as a major supplier of ICT products to the EU suggest a diversifying trade landscape. The increasing economic interdependence between China and the EU highlights the potential for enhanced bilateral trade relations that leverage complementary strengths for mutual benefit. Moreover, the global economic environment remains dynamic, with technological advancements and sustainability initiatives playing increasingly central roles. China’s pivotal position in the production of critical raw materials, combined with Europe's technological and regulatory advancements, presents opportunities for deeper collaboration on global challenges such as climate change and digital infrastructure. In conclusion, while 2023 was a year of notable shifts and challenges, it also set the stage for innovative adaptations and strategic partnerships. The resilience and adaptability demonstrated by key players in the global market are likely to drive future trade policies and economic strategies, ultimately shaping a more interconnected and technologically integrated global economy. As the world navigates these changes, the role of strategic foresight and collaborative policy-making will be crucial in harnessing the full potential of these evolving trade dynamics.

Source: CBS

Editor: Lucy van Eck