BenCham COVID19 Survey Part III: Change and Opportunities

At the beginning of the COVID19 crisis, in early February 2020, the Benelux Chamber of Commerce Shanghai set up a program in order to bring answers to Benelux business community concerns regarding COVID19: BenCham COVID19 Experts Program. The purpose of the survey is to know how the virus situation impact Benelux community’s business and what are the perspectives.

How?

We are constantly and directly in touch with our community on a 7/7 basis via mobile phone/social media/mail and hotline. BenCham is providing:

• Official announcement from gov. bodies (CN/Benelux)

• Documentation and analysis on specific COVID19 topics

• Wechat dedicated group

• Surveys

• Webinars

• 101 consultations

• Toolbox

• Facilitation and support in the re-entry to China process

ReCap Survey I & II

BenCham COVID19 Survey Part I

BenCham survey Part 1 on COVID-19 was conducted during the first 2 weeks of February 2020.

• Almost 50% of BenCham member companies answered the survey part I. Among them, 52% are based in Shanghai area, 21% in Beijing, another 21% in PRD, and 6% abroad. These companies represented all sectors and sizes of Benelux companies in China.

• Almost 90% of the surveyed companies estimated that the COVID-19 would negatively impact their business, while some other companies (7%), especially in consulting, thought that the crisis is also an opportunity.

• People’s concerns in the beginning of the pandemic concentrated on 4 aspects:

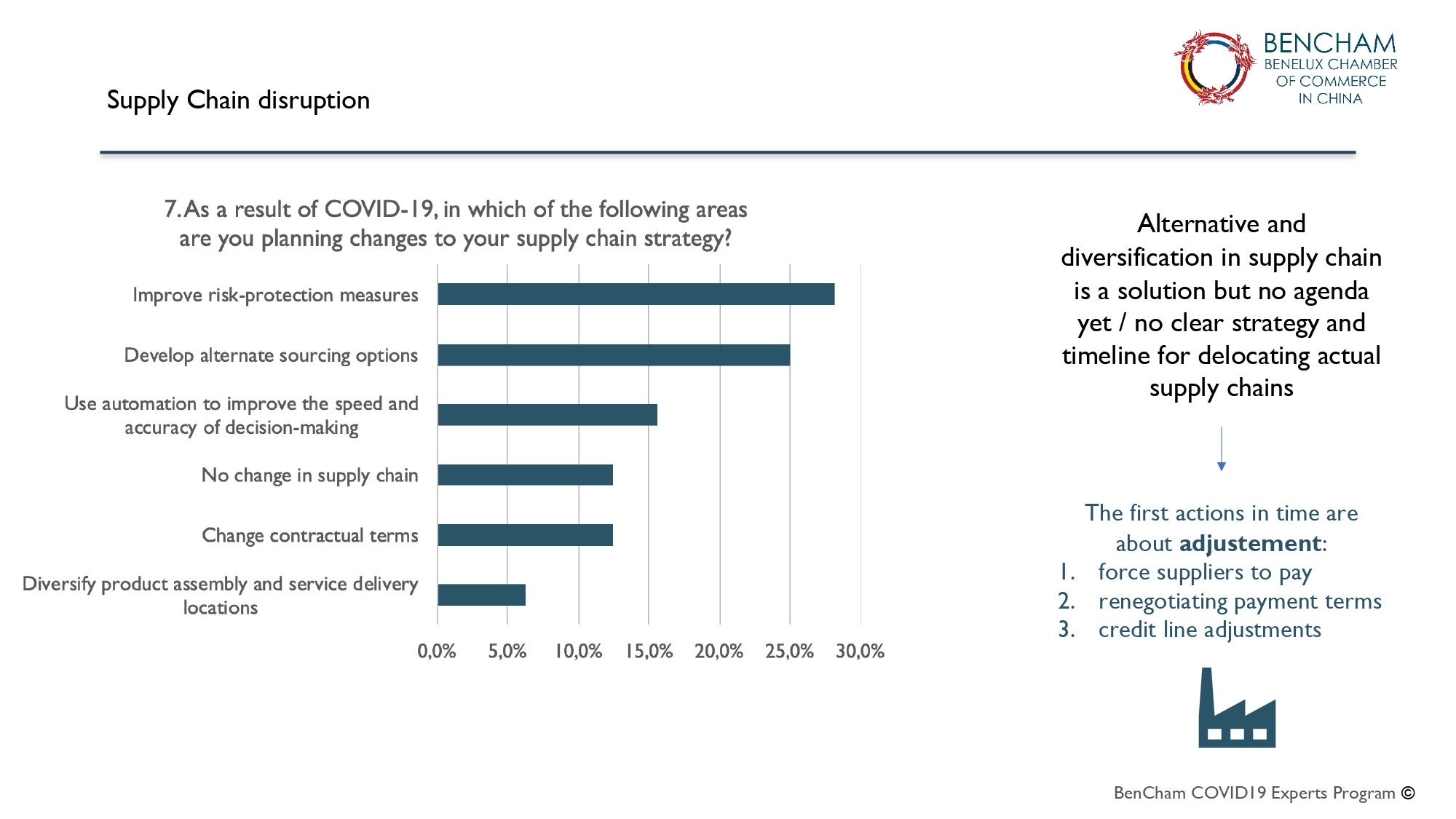

• supply chain disruption (54%)

• cash flow shortage (43%)

• losing market share (36%)

• increased HR turnover (18%)

BenCham COVID19 Survey Part II

BenCham survey Part II was launched late March 2020 and address the impact and implications of the COVID19 pandemic.

The first biggest impact of COVID19 is Human: 95% of Benelux enterprises in China indicated the biggest impact is on HR.

• HR turnover problems

• Staff shortage

• Salaries payment

• Annual leave regimen during the extension of the CNY holidays

• Quarantine status for returnees after the end of the official holidays

• Efficiency measures regarding working-from-home in maintaining daily operations

Second impact is on the Supply chain disruptions through having suppliers (30%) and customers (30%) in quarantined areas.

• From the moment of the outbreak, most companies indicated it will take more than 10 weeks to resume work. By the end of February, almost 70% of our surveyed companies reopened their offices/factories. There is an evolution since the survey n.1: foreigners are not encouraged anymore to leave China.

• Business sentiment is optimistic despite the impact - maintaining a strong link with customers is part of the strategy. We could see their confidence reflected by their marketing focus. Over half of the surveyed companies didn’t change their marketing strategy during the outbreak but 22% were more engaged in CSR.

• 12.5% had shifted their focus to other markets which are a strong evolution from the 2% mentioned in the previous survey.