Caught in the Crossfire: ASML amidst the US-China Chip War

Photo 1: ASML extreme ultraviolet lithography equipment. Source: Bart van Overbeeke

“China is still a decade behind the U.S. in chip technology—but the world still needs the mature chips it’s making” says Christophe Foucet, current CEO of ASML1. In today’s world, the global tech industry, specifically the artificial intelligence (AI) companies such as NVIDIA, TSMC, Tencent, Samsung and Intel2, is exceedingly dependent on scientific and technological collaborative innovation within the semiconductor industry. The AI stocks in the S&P 500, the 500 largest US companies by market capitalization, have been extremely volatile3 due to investor overreaction and irrational exuberance, illustrated by the meteoric rise of NVIDIA which reached a market capitalization of $3.3 trillion USD and effectively became the world’s largest company for a brief moment in time. Furthermore, the share price of ASML gained 15% due to positive news that the US did not target ASML’s products for export restrictions to China4. ASML, which is the sole designer and manufacturer of extreme ultraviolet lithography machines (EUV)5, is the supplier for chip manufacturers to produce the most advanced 3 to 5 nanometer chips6. However, ASML was obstructed by the Dutch government and the United States to export their EUV lithography machines below 7 nanometers to China since 20197. A survey with the European Round Table for Industry8 found that this has contributed to a deterioration of relationships between the EU-China relations. Therefore, the export ban restrictions for ASML are a strikingly sensitive topic for the Dutch government in the domains of politics, economics, technology and national security.

According to the European Chips Act9, which is a policy-driven investment package of €43 billion (EUR) to stimulate public and private funds into the semiconductor industry until 203010, Europe has to improve its technological sovereignty, competitiveness, resilience through manufacturing semiconductors in order to contribute to the digital and green transitions11. Additionally, the Hague responded with five proposals (see footnote) to protect and promote Europe’s semiconductor ecosystem and value chain12. In fact, the White House has taken a firm stance to restrict access to cutting-edge technology to China by curbing exports of the Netherlands and Japan13. Correspondingly, Zhongnanhai (literally ‘Sea Palaces’, equivalent of China’s seat of government in Beijing) reacted against these restrictions with: “firmly opposing”14, “urged to respect market principles"15, “be impartial”16, “seriously violating wrongdoing”17. This article aims to inform the reader about ASML, the Dutch semiconductor industry and the US-China Chip War.

ASML and EUV lithography machines

In 1984 ASML started off as a joint venture with Philips and Advanced Semiconductor Materials International (ASMI). During the early start-up years, ASML experienced financial struggles, technological obstacles and skepticism from the semiconductor industry. However, through fostering strategic partnerships and focusing on solving the pain points of their customers, ASML transformed from a company on the brink of near bankruptcy to a global monopolist. Present-day, ASML is the 29th most valuable company in the world with 60 locations across multiple continents and consists of 42.000 employees worldwide with its headquarters based in Veldhoven18.

ASML designs and manufactures the EUV lithography machines, which cost around $380 million per piece19, and DUV (deep-ultra violet) lithography systems20. ASML buys manufacturing equipment and outsources top-notch materials in their supply chain to produce these machines from all around the world; the designs are from its software and R&D department in Silicon Valley, its precise optics from Germany and chemicals from Japan21. An interesting data point about the EUV lithography machines is that the EUV Drive Laser inside the machine of the EUV lithography is manufactured by ZEISS and Trumpf and consists of 457,329 components22.

Afterwards, the EUV lithography machines are shipped to semiconductor fabrication plants (fabs or foundry), e.g. TSMC, Intel, Samsung and NVIDIA, which produce semiconductors by using the extreme ultraviolet light to etch nanometers onto silicon wafers with as final product: microchips. TSMC produces around 90 percent of the world’s leading semiconductors that are used for AI and quantum computing applications23. The other fabs produce appliances that people use on a daily basis such as smartphones, automobiles, laptops, microwaves, fridges, lamps, air conditioners, headphones, public transport, coffee machines, washing machines, alarm clocks, TVs etc. Lastly, ASML has contributed unequivocally to the evolution of Moore’s Law24, which stipulates that the number of transistors on an integrated circuit will double every two years with minimal rise in cost. The question remains whether ASML can maintain this technological pace of innovation in the unforeseeable future.

A financial business analysis of ASML

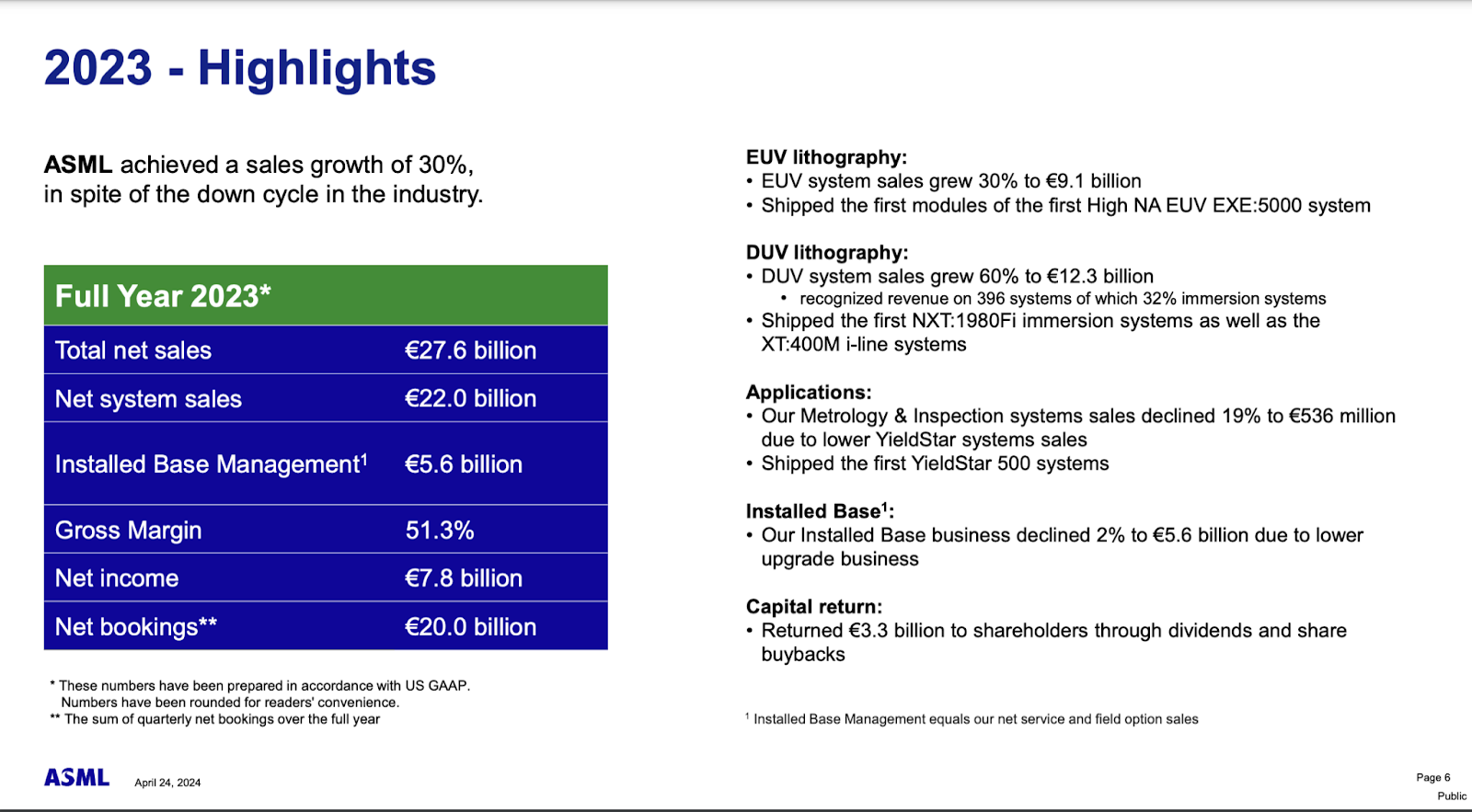

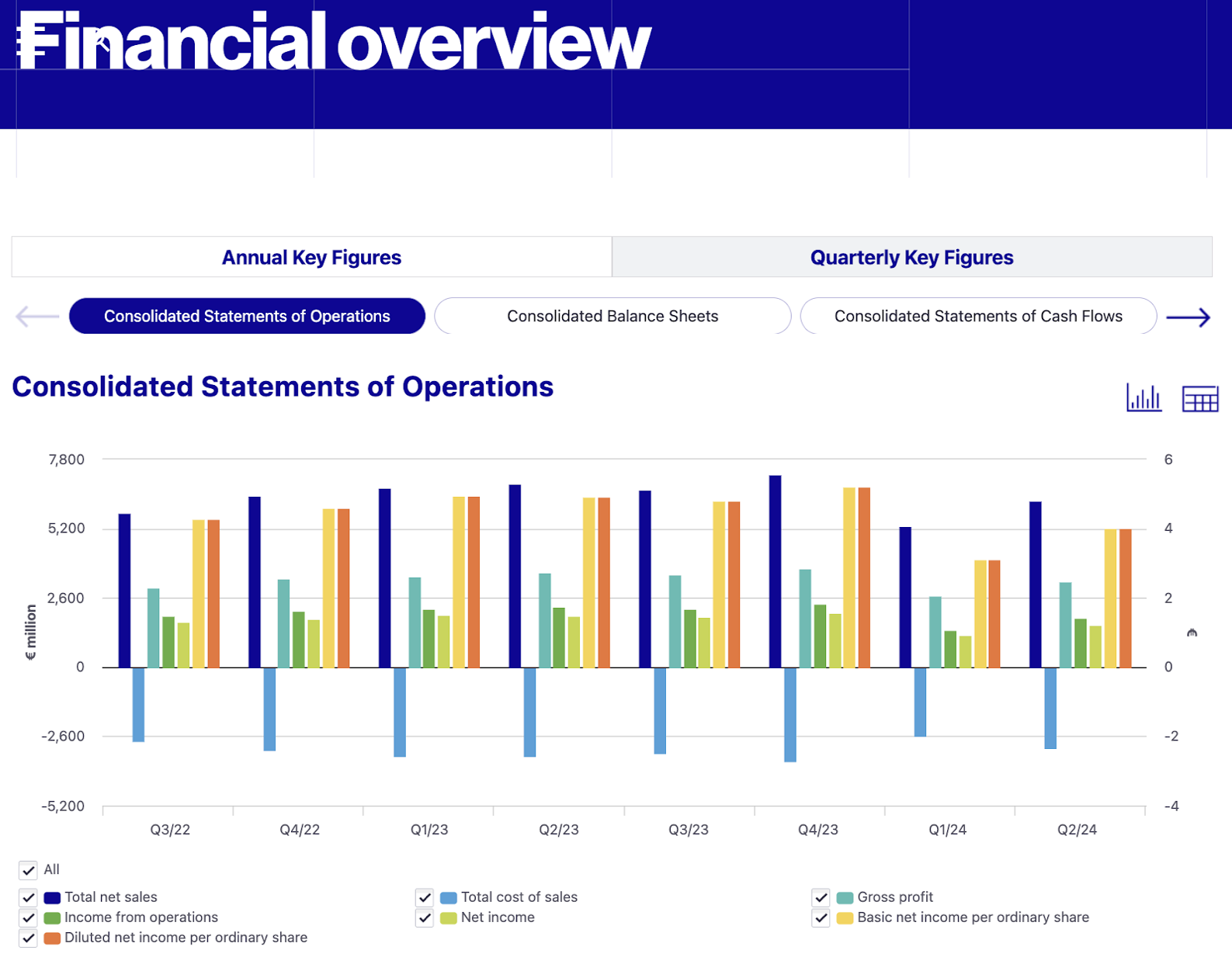

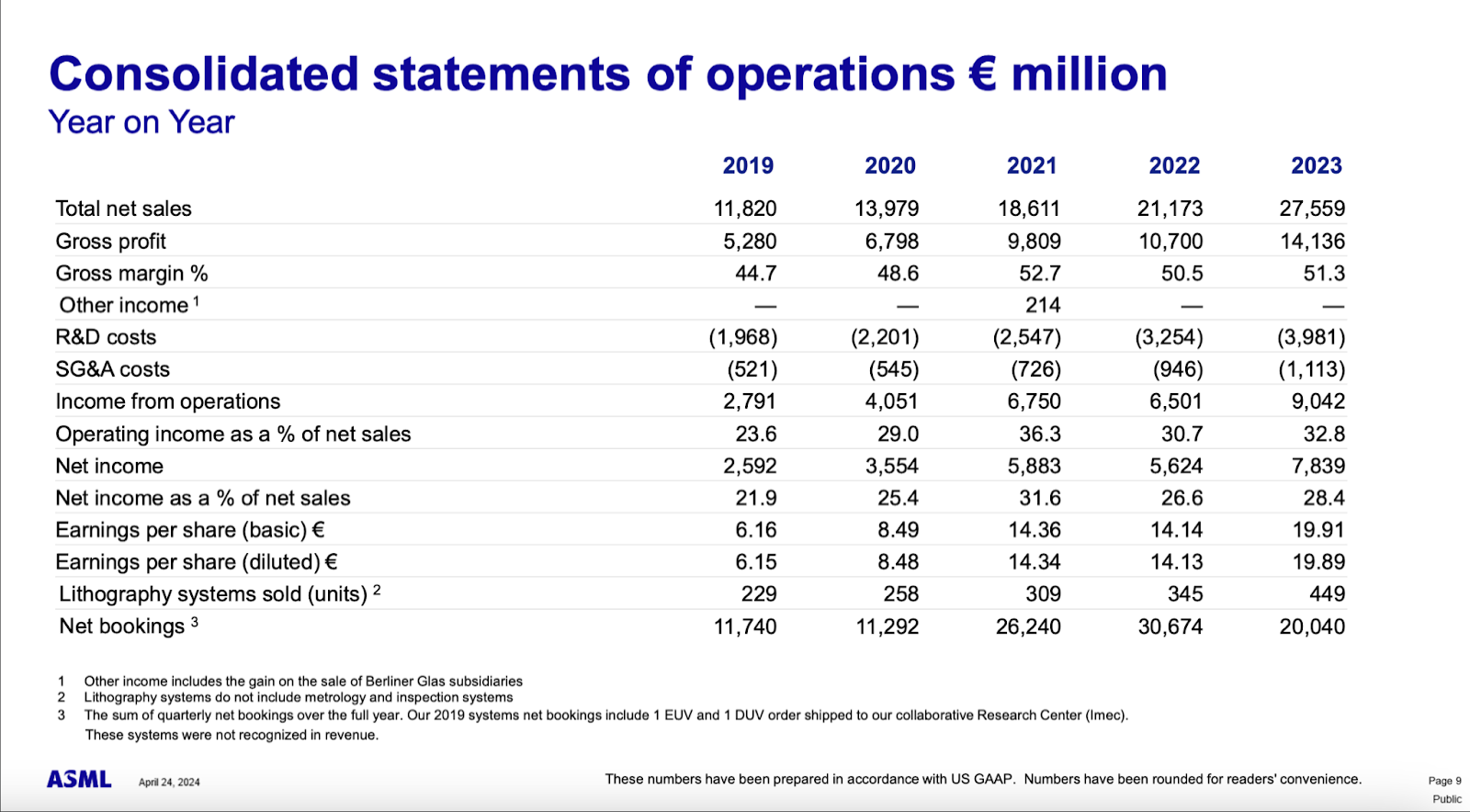

In the financial statements of 2023, ASML reported a total net sales of $29.5 B, sales growth of 30%, gross margin of 51.3%, net income of $8.35 B and earnings per share (EPS) of $21.30 (see figure 1). As of Q2 2024, ASML has a market capitalization of $331B USD, net sales of $6.8Bm, net income of $1.75B, a gross margin of 51.5% and sold 89 new lithography machines and 11 used ones25. For Q3 2024, ASML forecasted net sales of $7.34 - $8 B with a gross margin of 50-51% for Q3 202426 which suggests a positive outlook for the rest of 2024. Over the past 5 years, there is an increasing trend in total net sales, gross margin, R&D costs, net income, earnings per share and lithography systems sold for ASML(see figure 2 and 3)27. The balance sheet of ASML shows that the leverage (debt-to-equity ratio: 0.31) is relatively low and conservative; that the liquidity (cash & cash equivalents and short-term investments: $7.5 B) is adequate to cover interest expenses. This implies that ASML has minimized financial risk and sufficient cash reserve for contingencies. Therefore, the financial fundamentals of ASML can be considered robust, flexible and profitable28,29.

Furthermore, Marc Hijink, writer of “Focus - the ASML Way”30, argues that the business success behind ASML is largely contributed to the following factors: the firm outsources roughly 80% of its manufacturing process, its role as a system integrator, solid client relationship management with buyers and suppliers, the pure-play strategy on EUV, no excessive exposure during downturns to financial risks and debt leverage, continuous investments into R&D costs, a lean organization structure, and the company culture of a collective brain which exposes flaws early on and where the best ideas triumphed31,32. Therefore, ASML has an enormous economic moat compared to the competitors within the semiconductor industry due to the production of EUV lithography machines which require an extremely high input of capital expenditure, time in research and development, highly specialized and trained personnel, favorable business conditions and state-of-the-art technology.

Figure 1: The highlights of 2023 and key facts. Source: ASML Annual General Meeting 2024

Figure 2: Financial overview of ASML from Q3/2022 until Q2/2024. Source: ASML

Figure 3: Consolidated statements of operations of ASML from 2019 - 2023. Source: ASML

A Bird’s-Eye View of the Dutch Semiconductor Industry

The Dutch semiconductor industry is mainly concentrated around the hub of Brainport Eindhoven. This area is Europe’s most innovative technology region with 5000 high tech and IT companies working in this unique ecosystem33. Recently, the Hague announced “Project Beethoven” (a word joke on Veldhoven and Eindhoven) in which the government is investing $2.75 billion into the business climate for Brainport Eindhoven. It aims to solve the challenges that this region was facing: attracting talent, sufficient space, accessible transport and affordable housing34. Therefore, the Dutch and regional governments are promoting the attractiveness of this environment for the establishment of semiconductor companies. This is in alignment with the goal of the ‘Nationaal Groeifonds’ which is to increase the earning capacity of the Netherlands in a sustainable way35.

In 2023 ASML invested $4.35 billion in R&D expenses, approx. 14.4% of total net sales, which was utilized to push the technological frontier and sustainable innovation. These expenses mainly consist of personnel costs, material costs and prototyping, software development and collaborative research and technology licensing. A large portion flows into recruiting talent from universities such as the Eindhoven and Delft University of Technology (TU Eindhoven and TU Delft)36, collaborative research and partnership with TNO (de Nederlandse Organisatie voor Toegepast-Natuurwetenschappelijk Onderzoek)37,38. Furthermore, ASML received funding to invest in start-ups and scale-ups through the Deep Tech Fund of Invest-NL39 and ChipNL40, an interest group of more than 30 companies, has requested the Dutch government for additional support funding for the entire chip sector after ASML’s successful attempt. Thus, the Dutch semiconductor industry has cultivated a global technological leadership through innovation and a favorable business climate41.

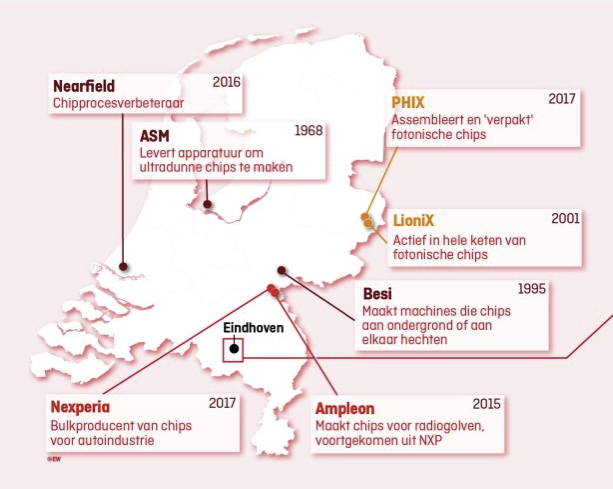

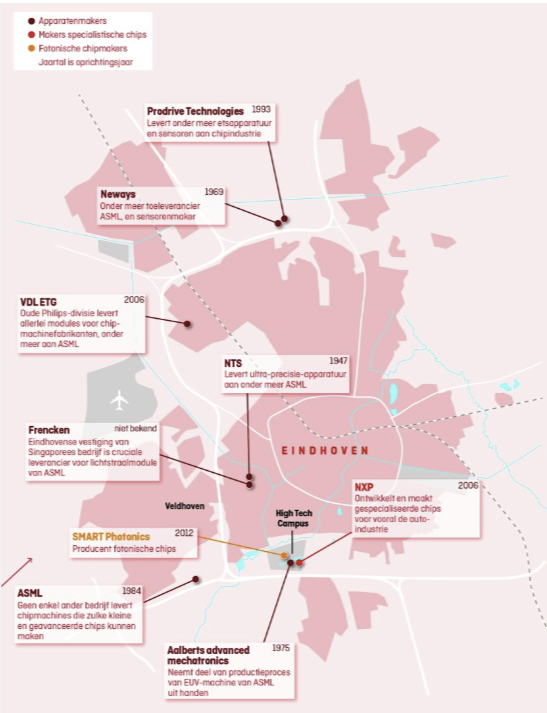

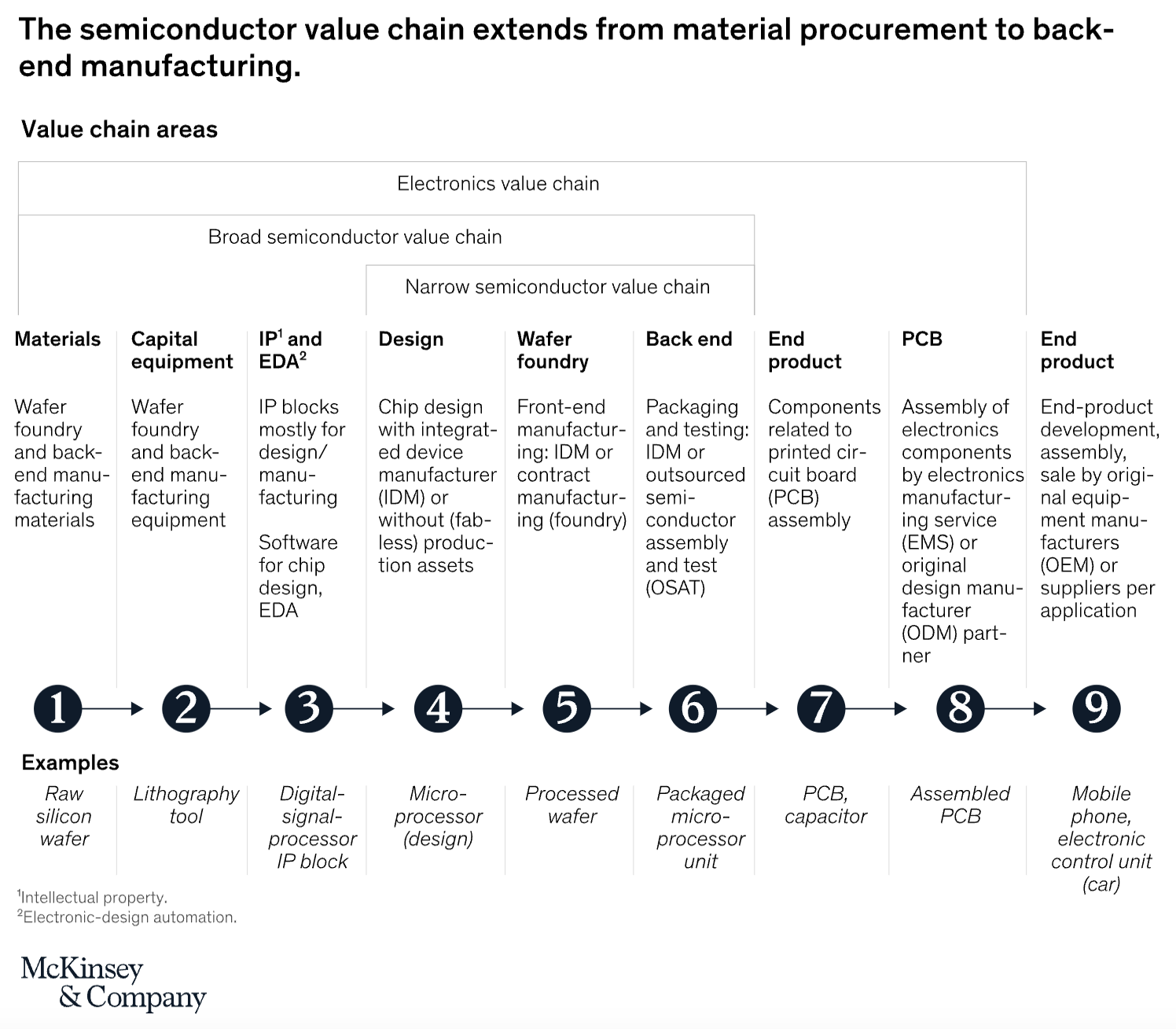

The Dutch semiconductor industry is considered the holy grail for the high-technology ecosystem and its role in the global supply chain. In this sector, ASML functions as a system integrator for the other Dutch semiconductor firms which can be categorized in manufacturing, designing and supplying firms: for example, Nexperia, NXP Semiconductors and BE Semiconductors (BESI), Nearfield, ASM International, STMicroelectronics, VDL and NTS42,43 (see image 1 and 2). An interesting note, private equity firms have been buying up the manufacturing firms that supply the manufacturing equipment to ASML44. Once the semiconductors or lithography machines have been processed, these highly sophisticated products are ready to be exported through the Port of Rotterdam or the airport of Schiphol to the rest of the world. Ultimately, ASML and the Dutch semiconductor industry are the indispensable puzzle piece in the bigger picture (see image 3).

Image 1 and 2: Manufacturing and equipment firms in the semiconductor industry in the Netherlands and Eindhoven, respectively. Source: EW Magazine

Image 3: The semiconductor value chain from material procurement to back-end manufacturing. Source: McKinsey & Company

The US-China Chip War

The United States and China are both competing in the race for technological supremacy with all its consequences for national security, political and economic dominance. Ray Dalio, chief investment officer of Bridgewater Associates, argues that technological supremacy is a critical factor for the rise and fall of nations, particularly in artificial intelligence, quantum computing and biotechnology45. The Biden administration implemented the CHIPS and Science Act in 2022, which invested $50 billion into semiconductor companies such as Micron and Qualcomm, with the aim to revitalize domestic manufacturing, create job employment, strengthen supply chains and counter China46 (see image 4). The United States exploits technological chokepoints and access to cutting-edge semiconductor technology such as export ban restrictions for ASML’s EUV lithography machines. Prior to this, China had invested massively in the domestic semiconductor industry to reduce reliance on foreign technology, illustrated by the China Integrated Circuit Industry Investment Fund ($47.5 billion)47 and Made in China 202547. In this playbook, China seeks to achieve 70 percent self-sufficiency in high-tech industries by 2025 and by 2049 a dominant position in global markets49. Therefore, China and the US are strategically positioning themselves to develop and maintain a technological competitive edge and become less dependent on foreign technology.

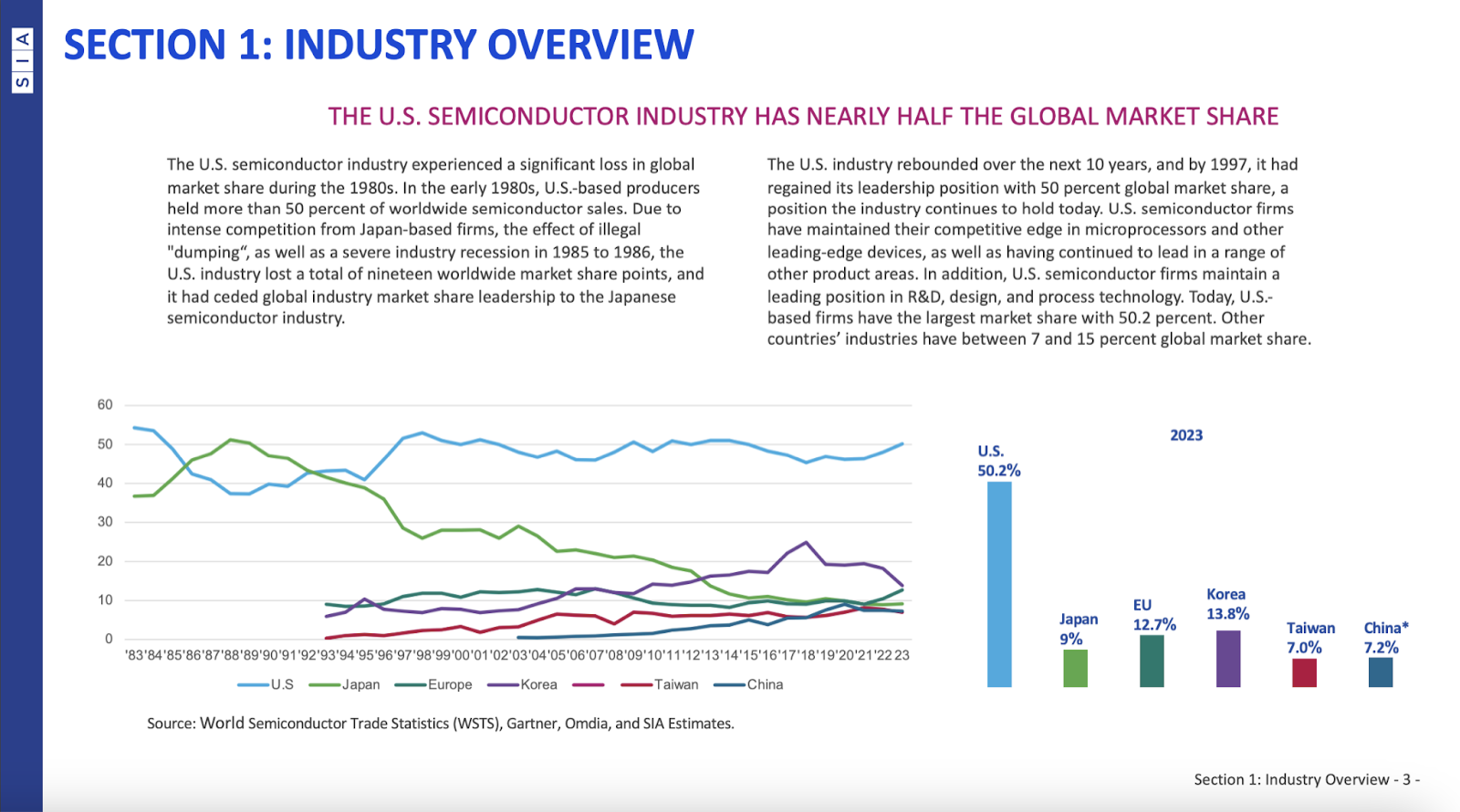

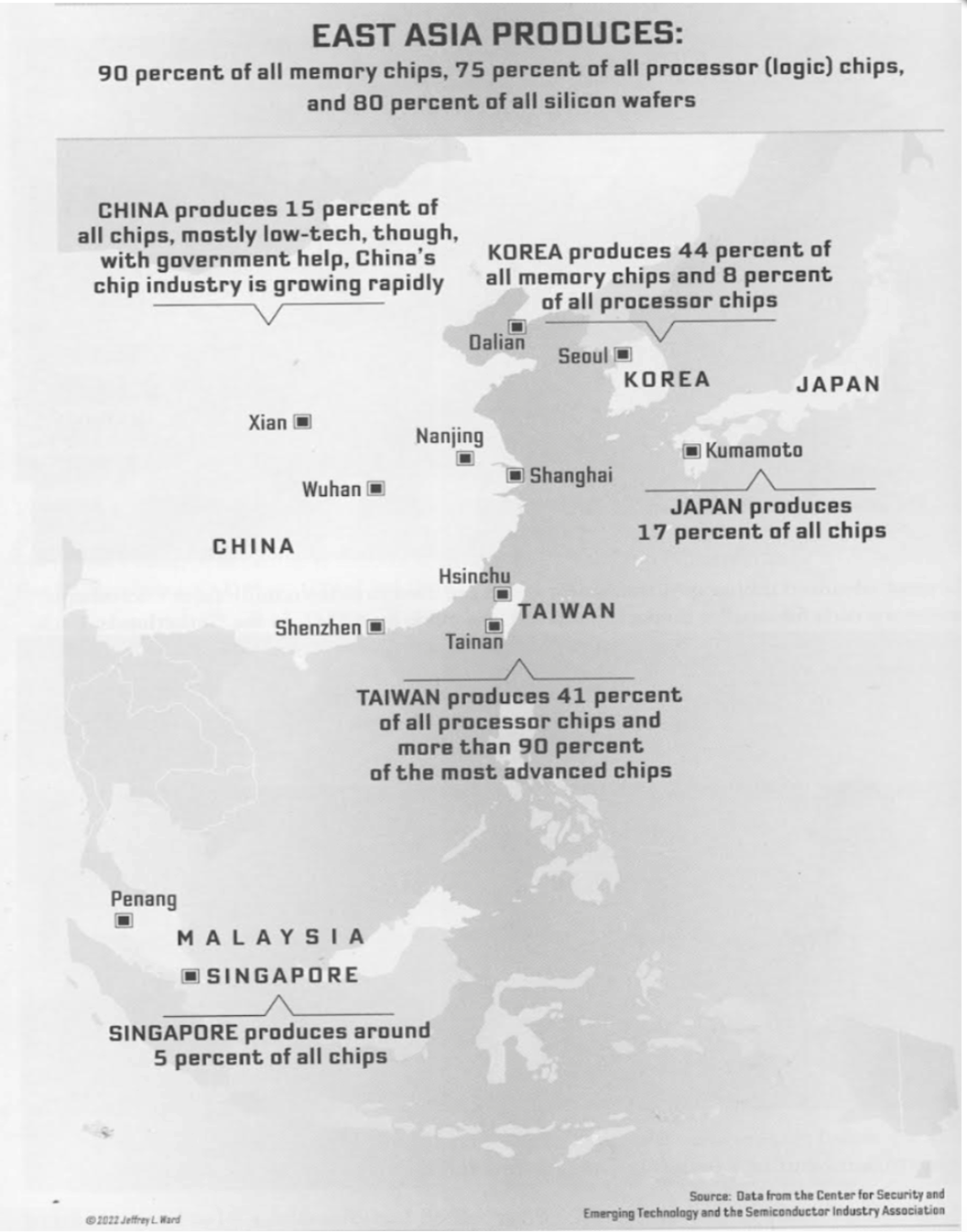

The US-China Chip War, part of the broader tech and trade war, has significant economic implications for the global semiconductor supply chain. The Semiconductor Industry Association reports that global semiconductor industry sales are forecasted to increase from $526.9 billion in 2023 (after a decrease of 8.2 percent relative to 2022) to $588 billion in 202450. However, this technological rivalry which creates a strong demand for mature, advanced and mainstream chips can intensify the next global chip shortage, thus increasing supply chain disruptions and major price increases. In fact, Chinese companies such as Huawei, ZTE, SMIC, SMEE, Fujian Jinhua have been added to the Entity List of the US Bureau of Industry and Security - blacklisted for trade - are forced to stockpile, build inventory51 and focus on production of legacy chips52. Conversely, American companies like NVIDIA, Intel, Qualcomm and AMD are restricted to sell more advanced AI chips to Chinese companies, therefore produce AI chips with reduced capabilities53, seek solutions for alternative supply chains options54, e.g. TSMC relocating to Arizona55, or shift production to a more politically stable region, i.e. China Plus One Strategy56. Additionally, Japan57 (Tokyo Electron and Renesas Electronics) and South Korea58 (Samsung Electronics and Hynix) have unveiled investment blueprints in order to support their semiconductor industries. Thus, the Chip War will lead to more investment in domestic supply chains for China and more disruptive, protective policies for the United States.

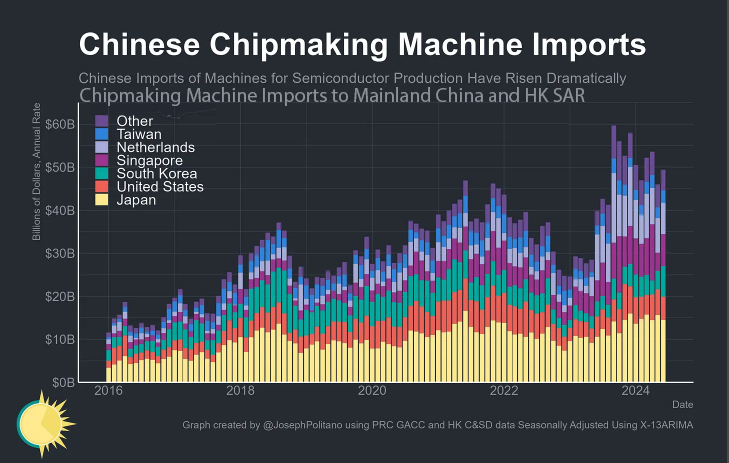

Furthermore, Chris Miller, author of “Chip War: The Fight for the World's Most Critical Technology” provides the reader with a comprehensible historic, economic, technological, geopolitical and strategic perspective on the importance of the semiconductor industry for the US-China rivalry. From the early days of Robert Noyce, Morris Chang, Jack Kilby, Gordon Moore, the pioneers of the semiconductor industry, to the genesis of Silicon Valley in Palo Alto and the tech companies like Fairchild Semiconductor, Texas Instruments, Hewlett-Packard, Intel and AMD, to the military and national security involvement during the Cold War of the Pentagon and Department of Defense. Halfway around the world, Morris Chang built the semiconductor industry for Taiwan (TSMC), South Korea and Japan followed suit and Richard Chang for China (SMIC), see image 5. Nowadays, China is playing catch-up and poised to dominate the legacy chips market59, it is funding state-owned enterprises to obtain the largest market, not necessarily profit-driven, which could lead to potential “overcapacity” in the near future. An interesting datapoint is that China has spent more than $300 billion in 2018 to $400 billion in 2023 on importing microchips rather than on oil, this implies it has become the most valuable commodity for China. Therefore, the age of ambition of China is extraordinary60, however, the government and companies are heavily dependent on foreign machinery and manufacturing for cutting-edge technology (see figure 4 and image 5).

Image 4: Overview of Global Semiconductor Industry. Source: Semiconductor Industry Association

Figure 4: Chinese Chipmaking Machine Imports. Source: Joseph Politano

Image 5: Production of chips in East Asia. Source: CSET and SIA

Future of ASML?

Several similarities can be made with the ongoing scenario and the trade conflict between the United States and Japan in the late 1980s61. After World War II, The United States lost its market dominance related to DRAM chips, dynamic random access memory, in the semiconductor industry to Japan in three decades. Afterwards, the US responded with technology protectionism. Consequently, the 1986 U.S.-Japan semiconductor agreement was signed, which in retrospect was criticized by the Bush government as “a price-fixing cartel” and “impediment of the free market system”. Furthermore, the Reagan administration penalized this bilateral dispute by imposing 100% tariffs on Japanese semiconductor exports for the value of $300 million USD in 1988 (approximately $800 million in today’s value)62. Ultimately, Japan entered the Lost Decades (1990s) in which Japan started struggling with a deflationary environment after the Japanese asset price bubble popped due to overvalued real estate and stock prices63.

However, China is not Japan, in political, economic, social, technological, environmental and legal aspects but it could lead to a similar course of events - geopolitical tension, trade wars, protectionism, tariffs and quotas, export restrictions and bans, disruption in global supply chains, higher inflation and legal disputes. Eventually, the US-China rivalry will decide how the balance of power, thus the world order, will be recalibrated for the other 193 countries. The military battlefields have turned digital information technology and through cyber warfare: i.e. AI chips, data centers and cloud computing64. History doesn't always repeat itself but it often rhymes.

A thought experiment for the reader: “Integrating China into the global system will build up strong vested interests in China to play by international rules. It will increase China’s interdependence for trade, services, investments, technology, and information. These interdependent links could increase to a point where to break them in a unilateral breach of international obligations would carry unbearable costs” spoke late Lee Kuan Yew65, founding father of Singapore. Is this not an entertaining thought? Or are we supposed to wait for a global schism between the West and the US versus China and the Global South? May we live in interesting times?

The future of ASML remains unclear but seems promising. However, there is a fair probability that more export ban restrictions for ASML will occur unexpectedly and a high likelihood that China will craft manufacturing measures for industrial policy related to the semiconductor industry in order to compete with the United States, become more self-reliant and less dependent on the chips from Taiwan, Japan, South-Korea and Singapore. Former ASML CEO, Peter Wennink, argued that "These kinds of discussions [related to US-China race for technological supremacy] are not being conducted on the basis of facts or content or numbers or data but on the basis of ideology”.

Written by Tjan Ho Lai - 14th of August

- https://fortune.com/asia/2024/07/09/china-still-decade-behind-us-chip-tech-asml-ceo-christophe-fouquet-peter-wennink/

- https://companiesmarketcap.com/tech/largest-tech-companies-by-market-cap/

- https://www.google.com/finance/quote/VIX:INDEXCBOE?window=6M

- https://fd.nl/bedrijfsleven/1525676/vs-ontzien-asml-van-exportrestricties-koers-stijgt-fors

- https://www.asml.com/en/products/euv-lithography-systems

- https://www.datacenterdynamics.com/en/news/intel-acquires-asmls-entire-2024-stock-of-high-na-euv-machines/

- https://eindhovennews.com/news/2024/02/export-restrictions-damage-asml/

- https://www.reuters.com/business/europes-business-chiefs-see-eu-china-relations-worsening-2024-05-29/

- https://www.european-chips-act.com/

- https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age/european-chips-act_en

- https://digital-strategy.ec.europa.eu/en/policies/european-chips-act

- https://www.tweedekamer.nl/downloads/document?id=2021D38167

- https://www.reuters.com/technology/us-official-acknowledges-japan-netherlands-deal-curb-chipmaking-exports-china-2023-02-01/

- https://www.scmp.com/tech/tech-war/article/3221582/tech-war-china-slams-japans-semiconductor-technology-export-controls

- https://www.reuters.com/technology/asml-says-dutch-government-revoked-some-export-license-2024-01-01/

- https://www.asiafinancial.com/dutch-block-asml-from-shipping-top-chip-machines-to-china

- https://www.reuters.com/technology/china-urges-japan-correct-its-wrongdoing-imposing-chip-export-controls-2023-05-29/

- https://www.asml.com/en/company/about-asml/history

- https://www.taipeitimes.com/News/biz/archives/2024/05/16/2003817914

- https://www.asml.com/en/products/duv-lithography-systems

- https://focus-dewereldvanasml.nl/

- https://www.trumpf.com/en_INT/newsroom/stories/euv-techology-beakthrough-thanks-to-master-laser-builder/

- https://www.cfr.org/blog/will-chinas-reliance-taiwanese-chips-prevent-war

- https://www.intel.com/content/www/us/en/newsroom/resources/moores-law.html

- https://www.marketscreener.com/quote/stock/ASML-HOLDING-N-V-12002973/news/ASML-reports-6-2-billion-total-net-sales-and-1-6-billion-net-income-in-Q2-2024-47396193/

- https://www.asml.com/en/news/press-releases/2024/q2-2024-financial-results-80ef70c80ffb6d2a

- https://edge.sitecorecloud.io/asmlnetherlaaea-asmlcom-prd-5369/media/project/asmlcom/asmlcom/asml/files/investors/shareholders/agm/2024/2024_04_24-agm-presentation-final.pdf

- https://www.asml.com/en/investors/annual-report

- https://www.asml.com/en/investors/shares/shareholder-meetings

- https://focus-dewereldvanasml.nl/

- https://www.youtube.com/watch?v=x7rdmTlBEQM&t=84s

- https://www.youtube.com/watch?v=59XmWLI4C3g&t=636s

- https://brainporteindhoven.com/int/

- https://www.government.nl/latest/news/2024/03/28/the-netherlands-to-invest-%E2%82%AC2.5-billion-to-strengthen-business-climate-for-chip-industry-in-brainport-eindhoven

- https://www.nationaalgroeifonds.nl/doel-nationaal-groeifonds

- https://www.asml.com/en/news/press-releases/2024/asml-and-tue-collaboration

- https://www.tno.nl/en/newsroom/insights/2023/12/partnership-built-dream-euv-success/

- https://data.rvo.nl/subsidies-regelingen/projecten/asml-plasma-mat-interaction

- https://www.asml.com/en/news/press-releases/2022/asml-participates-in-new-dutch-deep-tech-fund

- https://hollandhightech.nl/en/news-calendar/news/after-asml-the-entire-dutch-chip-sector-is-now-asking-the-government-for-support

- https://investinholland.com/news/semicon-in-the-netherlands-full-on-innovation/

- https://chiplix.com/semiconductor-companies-in-the-netherlands/

- https://www.ewmagazine.nl/economie/achtergrond/2024/07/de-unieke-nederlandse-chipindustrie-75133w/

- https://fd.nl/bedrijfsleven/1523682/private-equity-stort-zich-op-toeleveranciers-van-asml

- "Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail” - Ray Dalio

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/09/fact-sheet-chips-and-science-act-will-lower-costs-create-jobs-strengthen-supply-chains-and-counter-china/

- https://www.caixinglobal.com/2024-05-28/china-piles-475-billion-into-big-fund-iii-to-boost-chip-development-102200633.html

- https://www.csis.org/analysis/made-china-2025

- https://www.cfr.org/backgrounder/made-china-2025-threat-global-trade

- https://www.semiconductors.org/wp-content/uploads/2024/05/SIA-2024-Factbook.pdf

- https://www.bcs.org/articles-opinion-and-research/understanding-the-global-chip-shortage/

- https://rhg.com/research/thin-ice-us-pathways-to-regulating-china-sourced-legacy-chips/

- https://economictimes.indiatimes.com/tech/technology/intel-to-launch-two-ai-chips-for-china-with-reduced-capabilities/articleshow/109342233.cms?from=mdr

- https://techhq.com/2023/08/will-amd-find-a-taiwan-alternatives-as-us-china-chip-war-simmers/

- https://www.nytimes.com/2024/08/08/business/tsmc-phoenix-arizona-semiconductor.html

- https://www.ft.com/content/4e0017e8-fb48-4d48-8410-968e3de687bf

- https://www.nippon.com/en/japan-data/h01965/

- https://www.korea.net/NewsFocus/policies/view?articleId=251981

- https://www.scmp.com/tech/tech-war/article/3259221/chinas-semiconductor-output-jumps-40-first-quarter-amid-growing-dominance-legacy-chips

- https://time.com/6295902/china-tech-war-u-s/

- https://www.heritage.org/asia/report/the-us-japan-semiconductor-agreement-keeping-the-managedtrade-agenda

- https://www.reaganlibrary.gov/archives/speech/statement-tariff-increases-japanese-semiconductor-products

- https://www.nomuraconnects.com/focused-thinking-posts/japans-three-lost-decades-escaping-deflation/

- https://www.economist.com/schools-brief/2024/07/30/the-race-is-on-to-control-the-global-supply-chain-for-ai-chips

- “Lee Kuan Yew: The Grand Master's Insights on China, the United States, and the World” written by Ali Wyne, Graham T Allison, and Robert D. Blackwill