Chinese electrical vehicles taking over the EU market: EU strategies

Introduction

According to a recent study conducted by Transport & Environment (T&E), Europe's leading NGO conducting research about cleaner transport, Chinese-manufactured electric vehicles (EVs) accounted for approximately 19.5% of all EV sales in Europe last year. The analysis further projects that by 2024, the share of EVs produced in China and sold in Europe is expected to increase, reaching a milestone of 25%. The influx of EVs from China into Europe has predominantly consisted of models from Tesla, Dacia, and BMW that are manufactured in China. However, T&E anticipates a significant shift in the landscape, projecting that Chinese-branded electric vehicles could secure 11% of Europe's EV market by 2024, with this figure potentially rising to 20% by 2027. This forecast is based on a conservative estimate that assumes a steady increase in the market share of Chinese Original Equipment Manufacturers (OEMs) in Europe, hypothesized from growth patterns observed over the past two years. Notably, BYD, one of China's leading EV manufacturers, has set an ambitious target for itself, aiming to capture 5% of Europe's electric car market by 2025 alone. According to Electrek, an American news source dedicated to electric transportation and sustainable energy, BYD sold 15,644 electric cars in Europe in 2021, the most recent data point, which accounted for a 1.1% share of Europe’s EV market. This trend indicates a significant presence and influence of Chinese EVs in the European market. These developments are noteworthy against the backdrop of the global automotive industry's shift towards electrification. The trend underscores the rapid evolution of China's automotive industry, which has transitioned from being a domestic powerhouse to a significant exporter of electric vehicles. Chinese manufacturers have benefited from a robust domestic market that has allowed them to scale up production and reduce costs. Additionally, China's substantial investment in research and development has propelled advancements in EV technology, making Chinese-branded EVs increasingly competitive in international markets. Europe's growing demand for EVs, driven by stringent environmental regulations and a collective push towards reducing carbon emissions, presents a lucrative opportunity for Chinese automakers. The European market is particularly attractive due to its commitment to phasing out internal combustion engine vehicles over the coming decades. As Chinese EV brands continue to expand their global appearance, their increasing presence in Europe is an exemplification of the shifting dynamics in the global automotive industry, where the race for electrification is reshaping traditional market hierarchies and stimulating new international collaborations and competitions.

A response: Trade Tariffs

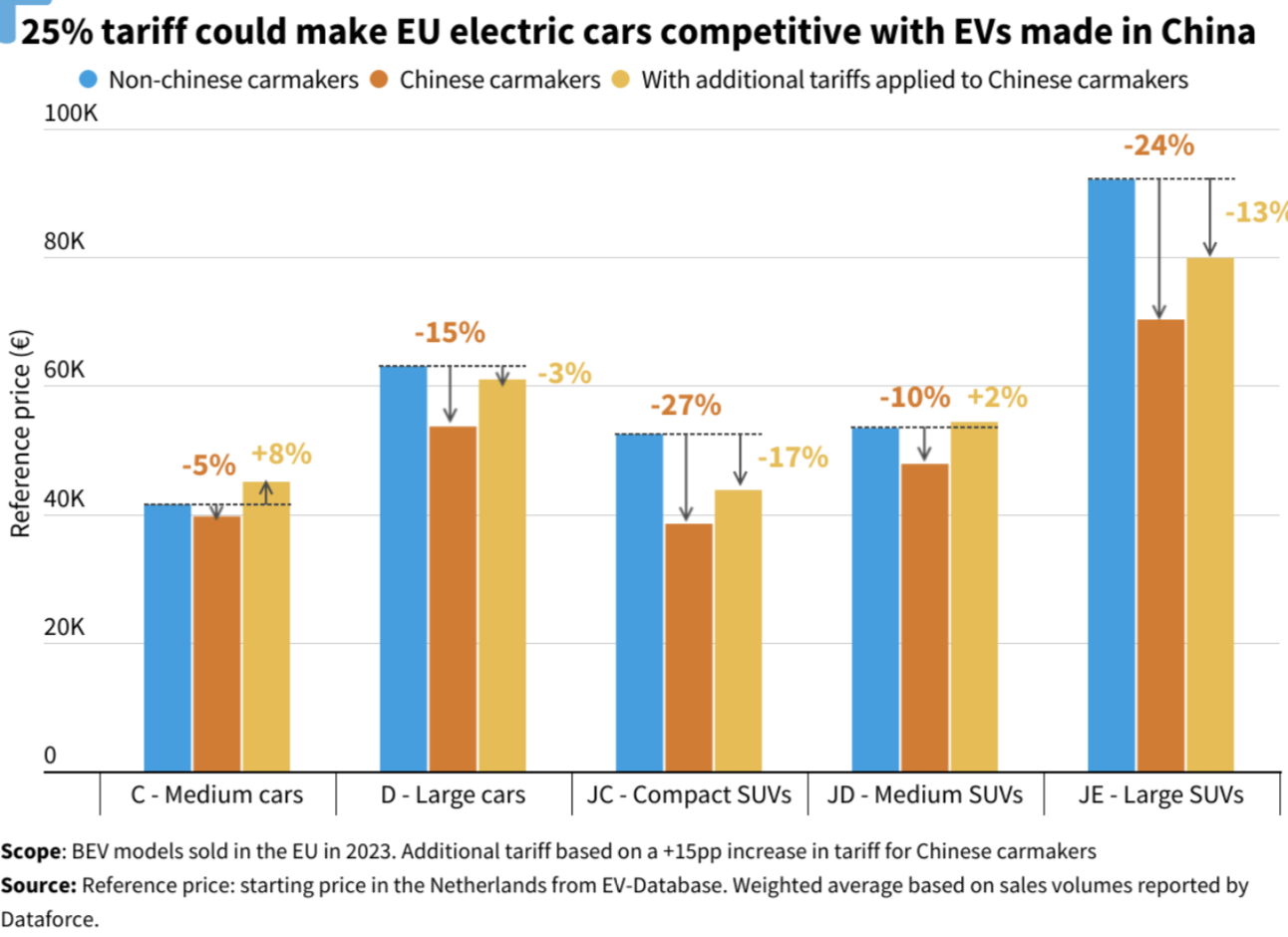

A speculated response of the European Union is to impose tariffs. The analysis conducted by T&E suggests that if the European Union were to increase the import tariff on all vehicles coming from China to 25%, the price of medium-sized Sedans and SUVs from China would surpass that of similar vehicles manufactured within the EU. This adjustment in tariff rates would essentially strengthen the competitiveness of European-made vehicles by making them more financially attractive compared to their Chinese counterparts, thereby advocating for the boosting of vehicle manufacturing within the EU. However, the analysis also indicates that despite the imposition of a 25% tariff, compact SUVs and larger vehicles imported from China are likely to maintain a price advantage, remaining somewhat less expensive than European equivalents. These forecasts are illustrated in Figure 1. The nuanced outcomes highlight the complexity of the automotive market, where the impact of tariffs can vary significantly across different segments of vehicles. The background to this analysis lies in the broader context of international trade and economic strategies aimed at protecting and promoting domestic industries. Tariffs are a common tool used by countries or unions such as the EU to regulate trade dynamics, protect domestic jobs, and encourage local manufacturing. By adjusting tariffs, governments can influence the flow of imports and exports to favor the domestic economy. Government subsidies, such as those provided by China, offer direct financial support to domestic industries, reducing their costs and enhancing their competitiveness both locally and globally. In the case of the automotive industry, which is a significant sector for many European economies, the competition from Chinese EVs has been growing. The potential adjustment of tariffs on vehicle imports from China by the EU reflects the balancing act between embracing the benefits of free trade and protecting domestic industries from unfair competition. It also underscores the strategic importance of the automotive industry in the transition to greener transportation options, a priority for the EU in its commitment to reducing carbon emissions and combating climate change.

Figure 1

Possible consequences of tariffs

But, T&E cautions against the EU adopting protectionist measures that could insulate its automotive industry from significant competition. Such measures, particularly in the form of high tariffs on imported vehicles, might restrict the availability of affordable EVs for European consumers. T&E emphasizes that while it's important to support domestic car manufacturers, it's equally vital to ensure that European citizens have access to a wide range of affordable and sustainable transportation options.

Moreover, imposing tariffs often triggers a significant backlash, not just from the targeted country or industry, but from the broader international community as well. This reaction stems from the interconnected nature of global trade, where unilateral trade barriers can disrupt supply chains, inflate prices, and lead to retaliatory measures. Countries affected by tariffs may respond with their own levies, leading to a cycle of trade restrictions that can hamper international economic relations and growth. Moreover, such actions can strain diplomatic ties, as they are perceived as protectionist and contrary to the principles of free trade advocated by numerous international agreements and organizations. In fact, the EU already has a rather protectionist reputation in place, which is not beneficial to further reinforce. The global economy thrives on cooperation and open markets, and tariffs introduce uncertainty and instability, affecting businesses and consumers worldwide.

Moreover, an indirect consequence of the tariffs is that Chinese automotive companies are likely to establish manufacturing plants within Europe itself. When this development occurs, it is imperative that the European car industry is prepared to face the competition head-on. This preparation, as T&E advises, should encompass modifications to the existing regulatory environment to stimulate the production of EVs.

Broader strategy

To balance the need for protecting the EU's automotive sector with the goal of promoting the adoption of electric vehicles, T&E suggests that any increase in tariffs should be part of a broader strategy. This strategy should include regulatory measures aimed at boosting the production of EVs within the EU. Specifically, T&E proposes setting electrification targets for company car fleets by 2030. This would be in addition to the already agreed-upon goal of achieving a 100% clean car fleet by 2035, which mandates that all new cars sold from that year onwards must be zero-emission vehicles. Furthermore, a key component of this strategy involves enhancing the EU's capacity for lithium-ion battery production, which is central to the EV supply chain. However, the challenge lies in the fact that Chinese manufacturers have already established a strong foothold in the lithium-ion battery market, leveraging advanced technology and large-scale production capabilities to offer batteries at prices 20% lower than those produced in the EU, according to T&E. This price difference exemplifies the urgency for the EU to not only accelerate its own battery production efforts, but also to innovate and improve efficiency to close the cost gap with Chinese manufacturers. Hence, tariffs will likely only offer temporary protection to established car manufacturers. European car manufacturers, known as legacy carmakers due to their long history in the industry, are therefore at a critical juncture. They must adapt to this shift or risk being overtaken by more rapid competitors, particularly from China, where the government and companies have been quick and smart to invest in EV technology and production. The suggestion to adjust regulatory frameworks and set ambitious EV production goals is aimed at ensuring Europe's automotive sector remains competitive and sustainable in this new era.

Conclusion

While the European Union may contemplate imposing tariffs as a measure to protect its automotive industry from the surge of Chinese EVs, such a strategy offers only a temporary solution. The real challenge—and opportunity—lies in the EU's ability to adapt and innovate within the rapidly evolving global automotive landscape. The significant presence of Chinese-manufactured EVs in Europe, expected to rise in the coming years, underscores the need for the EU to strengthen its own EV production capabilities and reduce dependency on external sources, particularly for critical components like lithium-ion batteries. Or, enter EU-China friendly partnerships, which could strengthen relations between the two regions and support the development of sustainable transportation solutions for people across both continents. T&E's analysis highlights a critical moment for the European automotive sector: to remain competitive, it must embrace electrification fully and foster advancements in technology and production efficiency. This includes setting ambitious targets for EV adoption and ramping up the domestic production of lithium-ion batteries, areas where China currently leads. Moreover, the potential backlash from imposing tariffs, both from targeted countries and the international community, emphasizes the complexities of global trade dynamics and the importance of fostering a competitive yet cooperative international automotive market. Ultimately, the path forward for the EU's automotive industry is not through protectionism but through innovation, strategic investment in the EV ecosystem, and regulatory frameworks that encourage sustainable growth. By focusing on these areas, the EU can secure its automotive future, ensuring it remains a key player in the transition to a greener, more sustainable transportation system worldwide.

Source: Transport and Environment (T&E)

Editor: Lucy van Eck