The Enigma of SHEIN : Unraveling the Success of the Mysterious Online Retailer

During our Director of Business Development & Marketing's last courses of his MBA program at Vlerick Business School, he had the opportunity to work with other professionals and study the case of SHEIN, the online retailer that has taken the fashion industry by storm. Founded in 2008 in Nanjing, SHEIN started as an online retailer of affordable wedding dresses. However, it quickly transformed into a fast-fashion powerhouse, surpassing established brands like Zara and H&M in value. Where could SHEIN's success be attributed to? How does its business model look like and how does it optimize its Operations and Supply Chain? This paper was published with approval of the authors.

SHEIN – The Mysterious Online Retailer

It took H&M 30 years between the founding of their first store to their first shop outside of Scandinavia.

SHEIN was founded in Nanjing, China, as ZZKKO. Originally, the company was an online retailer of affordable wedding dresses made in China but soold worldwide. But its founder, Chris Xu, was not a fashion guru but rather an IT expert, focussing on “search engine optimization”. Between its founding and 2012 the company underwent some name changes (to SHEINside) and mostly focused on optimising it’s advertising processes. SHEIN reportedly managed to advertise 70% cheaper

In 2012 SHEIN made the full switch to fast fashion and got a cash injection of $5 million which allowed Xu to hire 50 employees and relocate to Guangzhou. In 2015, a successful series B financing round of ±$45M allowed SHEIN to expand further, partly through the acquisition of several tech companies. Around this period, the real magic of SHEIN started. But first, we need to understand fast fashion.

Fast fashion is the term used to describe clothing designs that move quickly from the catwalk to stores to take advantage of trends. The collections are often based on styles presented at Fashion Week runway shows or worn by celebrities. Fast fashion allows mainstream consumers to purchase the hot new look or the next big thing at an affordable price.

– Definition from Investopedia.com

To deliver the latest trends both fast and cheap, you need extremely lean supply chains and operations. Even more so if your goal is to have flexible manufacturing, i.e. small production batches. SHEIN managed to do this by partnering with local manufacturers and by holding to the principle of paying on time (atypical in the Chinese manufacturing industry, where payment is often delayed). The next couple of years catapulted SHEIN to a unicorn after a series C round in 2017. More hirings, international expansion and a move to Panyu set the company up for its most profitable period yet.

So, what differentiates SHEIN from its competitors? Besides a vast online presence aimed mostly at Generation Z through social media apps like TikTok, SHEIN differentiates itself in being both fast fashion and having flexible manufacturing. While traditional fast fashion focussed on bringing the runway quickly to your stores, SHEIN brings internet fashion -propagated by celebrities and influencers- at lightning speeds and for peanuts to your doorstep. In fact, SHEIN is sometimes dubbed real-time fashion, due to its speed. In some cases, designs gaining internet attention are purchasable from SHEIN in less than two weeks!

However, the things that make SHEIN unique are also cause for controversies. On the one hand, SHEIN is often accused of stealing original designs from (independent) fashion designers (you decide

SHEIN’s Business in a Nutshell

Background

Every good business model starts with a clear value proposition: SHEIN provides value to its customers through its recognition and reputation as the company is a leading brand established in China. The company also offers its customers fashionable products at a low cost and sometimes offers them discounts.

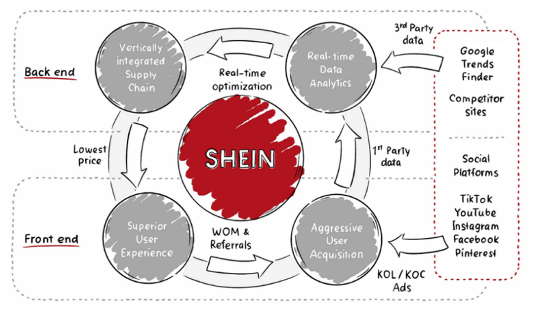

Figure 2. SHEIN's business model.

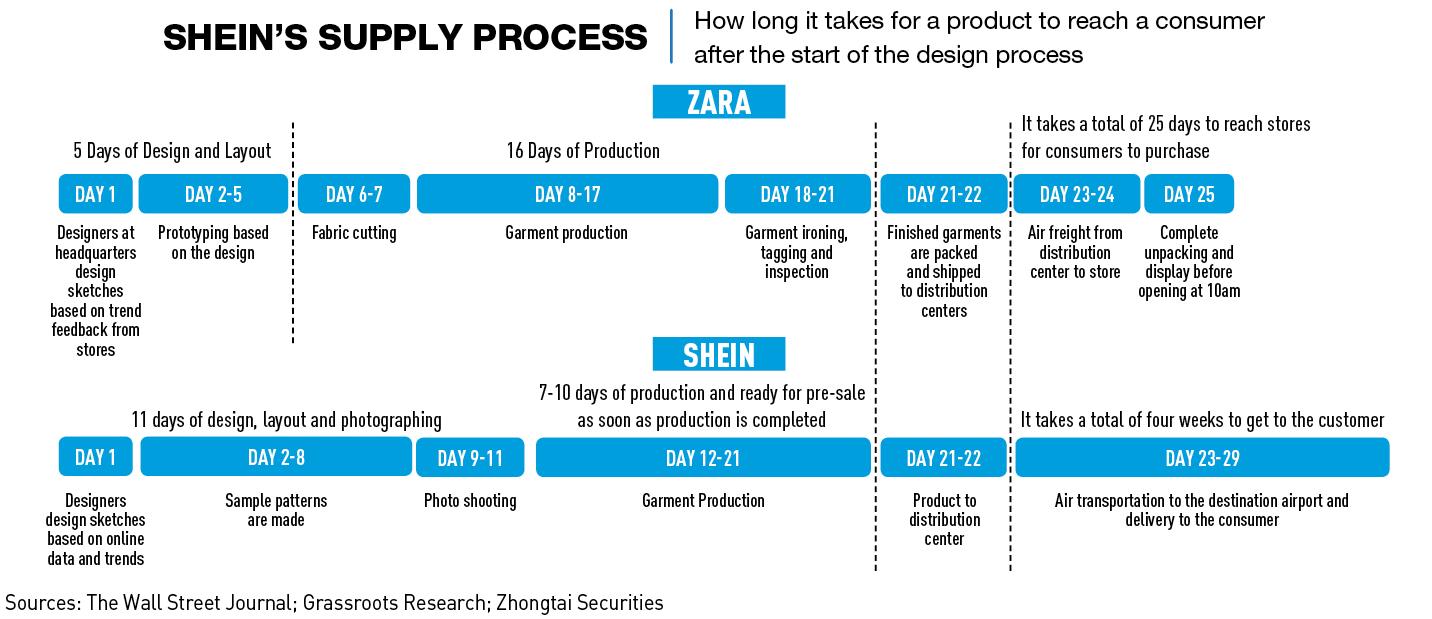

SHEIN adopts a daily update mode, with an average update rate of 4w-5w pieces per week, far exceeding the shorter cycle of ZARA. The price of SHEIN products is at a low level in the field of fast fashion, and the price of its best-selling products is also at the low-price band of ZARA and H&M. In 2019, SHEIN's inventory turnover rate reached 4.62 times, surpassing the high turnover rates of Inditex and Uniqlo, as well as the inventory level of China's leisure clothing industry. SHEIN only takes 14 days from product design, printing, and listing, and only 7 days from production and delivery to consumers after listing.

SHEIN created and follows a model which continuously optimizes the production line based on big data: it makes money by purchasing wholesale clothes and then selling them for a profit. It operates thousands of ghost factories that utilize proprietary inventory level management systems to increase supply chain efficiency. SHEIN maximizes profits by understanding its target demographic, becoming vertically integrated, and utilizing economies of scale. This makes the company ultra-competitive against the likes of ASOS and H&M (see Exhibit 1).

SHEIN’s Business in a Nutshell - From Design to Delivery

Testing thousands of new designs daily is what makes SHEIN a unique online fast-fashion retailer partnered with countless manufacturers to create and market new clothing styles. Through partnerships with factories, SHEIN manages the entire production chain for its clothing collection. Upon spotting a new trend, SHEIN employs its advanced technology to request a sample product from the factories. Once the sample is manufactured, it undergoes thorough testing. If the product passes the test, it is promptly distributed to a wider array of customers.

Over 220 countries receive shipments from the company which runs exclusive websites and apps for different regions. A variety of payment options such as credit and debit cards, PayPal, and “buy now, pay later” services are available to customers who can add products to their shopping bag.

SHEIN has a unique way of identifying trending designs. Rather than relying on traditional methods, it uses data from Google Trends, social media hashtags, and competitor analysis. An in-house design team then interprets this data and creates fashionable products. Using its manufacturing partners and in-house software, SHEIN can rapidly produce new designs, creating over a thousand new products daily. To promote their products, SHEIN utilizes a variety of customer acquisition tactics: these include partnering with influencers and sponsoring TV shows. To entice customers to make purchases, SHEIN also uses gamification techniques and offers discounts. Generating revenue by selling discounted clothing, SHEIN has projected an impressive $30 billion in sales for 2022. The company also aims to establish users' habits utilizing its platform and encourages sharing hauls.

Figure 3.2 SHEIN Optimization & Design Process

But why is this such a successful business model? Let’s look at their operational metrics and supply chain strategies.

Operational Metrics and Supply Chain Strategy

SHEIN as a Fashion Company

The production strategy of SHEIN can be described as efficiency through the fast-fashion business model and small-batch production approach. As mentioned above, the fast fashion business model refers to a retail strategy that aims to deliver trendy and affordable clothing and accessories to consumers at a rapid pace. Key characteristics of the fast fashion business model include quick response, agile supply chains, low-cost production, low prices, regular inventory turnover, and global retail presence. SHEIN has adopted this model, opting to provide customers with its products very fast and at a low cost, and deciding to lessen the emphasis on quality.

SHEIN isn’t a publicly traded company just yet, nevertheless we tried to compare some operational metrics with other benchmark players (such as Zara). For the analysis, we analysed the inventory turnover, lead times and massive volumes (throughflow) by using the latest available data. These operational metrics have shown to be of utmost importance.

Inventory Turnover (Representing “Inventory”)

During the COVID-19 pandemic, most retailers that went out of business were victims of inventory.

Lead Times (Representing “Time”)

The ability to reduce lead times is a competitive advantage for fashion retailers as most of them must anticipate the desires of their customers nine months in advance.

Figure 4. Zara's versus SHEIN's supply chain, represents how long it takes for a product to reach a consumer after the start of the design process in 2021.

Through just-in-time inventory management and efficient logistics, SHEIN can minimize lead times and ensure products reach the market quickly. To do so, SHEIN keeps up with the current fashion trends established by renowned fashion houses and brands and utilizes market information to anticipate upcoming trends, enabling it to market itself as true “fast” fashion.

Massive Volumes (Through Flow)

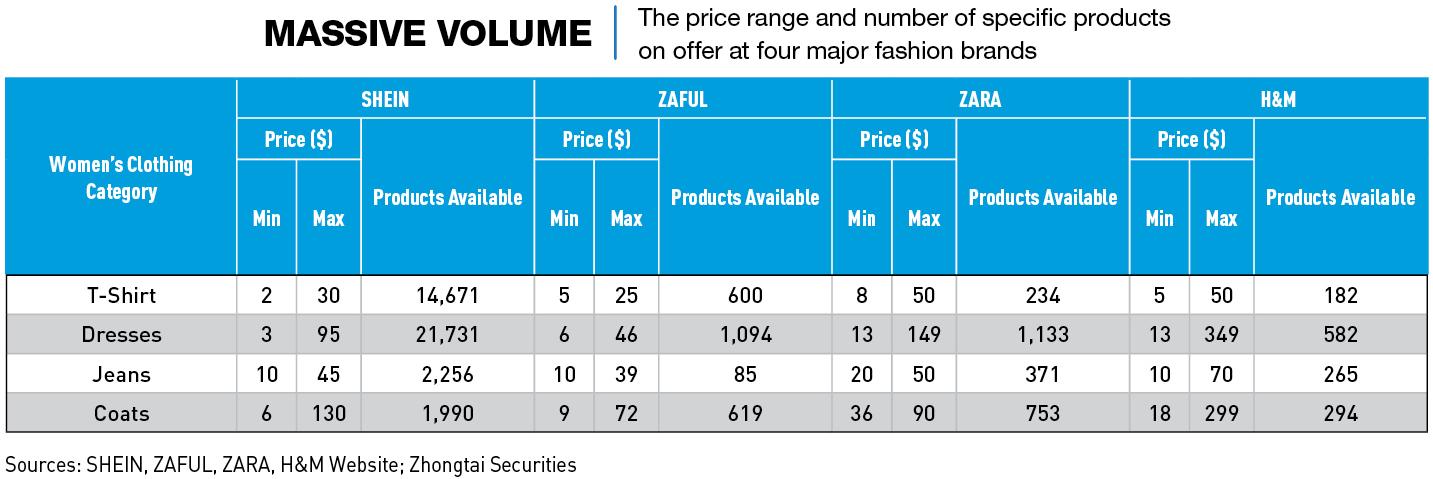

SHEIN seems to have a very high throughflow in variety, as seen in Figure 5.

Figure 5. Massive volume representing the price range and number of products on offer at four major fashion brands.

SHEIN indeed places high importance on regular inventory turnover and frequently introduces new collections and constantly refreshes its product offerings. It is estimated that SHEIN launches about 5,000 to 8,000 stock-keeping units and 200 or so new styles daily.

To enable such quick production manufacturing costs are optimised through strategic outsourcing to regions with favourable labour rates. Moreover, trend-based designs are distributed to a wide network of small Chinese manufacturers through a bidding system similar to Uber's.

Digital Supply Chain Operations - Use Of Technology

As an e-commerce company, SHEIN heavily relies on digital technologies to streamline operations and enhance efficiency. This typically involves implementing various technologies such as automation, data analytics and artificial intelligence. One example is its digital thermal transfer printing technology, in which dyes are printed onto thermal transfer paper before being transferred into the fabric to form a pattern to support small batch production. Another example is its AI program, which matches local demand and allows SHEIN’s supply chain to react in real-time and reduce operating costs.

When we look at the impact of such technology on employees, this can be both positive and negative. On the positive side, technology has the potential to automate repetitive tasks, and improve overall productivity. However, the introduction of technology can also disrupt job roles, even making some jobs obsolete. In the context of SHEIN, it is currently more likely that technology serves as a complement to human work rather than a complete replacement. SHEIN heavily relies on human expertise for tasks involving creativity: the process can (not yet) be fully automated. However, since AI is used to see what sells, which will enable fashion companies to create similar designs, and since algorithms are put in place to analyse customer’s past purchasing behaviour, one could wonder whether in the future creativity will still be needed, or whether everything will be AI-based. If this is the case, the already highly automated fast-fashion industry might evolve to include very few human elements.

Sustainability

SHEIN's production volume is remarkably high, contributing to what some call an unsustainable model. The approach where every item undergoes initial production in small quantities before scaling up when they gain popularity leads to manufacturers extensively using virgin polyester, heavily relying on oil consumption. Consequently, SHEIN leaves behind around 6.3 million tons of carbon dioxide annually. This figure falls far short of the United Nations' target to reduce global carbon emissions by 45% by 2030, a goal deemed crucial for fashion companies to adopt to mitigate global warming.

SHEIN is nonetheless active in improving sustainability and reducing waste and is committed to promote continuous improvement of processes to eliminate waste. As mentioned above, SHEIN promotes the widespread application of digital heat transfer printing technology to improve printing efficiency and reduce its environmental impact. Since the application of this technology in 2018, SHEIN's products using digital heat transfer technology have exceeded 50% and 590,000 tons of water have been saved. Another example is its improvement of the classification and recycling of industrial waste in warehouses. Data shows that as of December 2022, 75.4% of recyclable industrial waste has been separated from a warehouse for recycling and reuse, while the rest has undergone zero landfill treatment. Additionally, and to answer growing criticisms, SHEIN announced in October 2022 that it would spend $7.6 million on a partnership with the non-profit Apparel Impact Institute, which works with manufacturers to set and implement energy efficiency programs. It also aims to reduce supply chain emissions by 25 per cent by 2030. At the same time, SHEIN is working with Brookfield Renewable Partners to address greenhouse gas emissions in its supply chain by transitioning to powering the operations of SHEIN's supply chain partners with renewable energy.

Time will tell whether SHEIN will truly be able to decrease its impact on the environment, but it is very clear that outside pressure is very high, forcing them to tackle this issue.

Labor Practices

SHEIN has faced criticism for its labour practices, and more particularly allegations of low wages, poor working conditions, and potential exploitation in its supply chain. Even though SHEIN has published a supplier code of conduct,

Others have come to similar findings when conducting research: advocacy groups and journalists discovered evidence that clothes were manufactured in unsafe workshops lacking safety protocols and many workers were found to be employed without contracts or minimum wage requirements, allowing the company to withhold proper payment. SHEIN eventually acknowledged the violations, released a statement emphasizing their responsibility to protect the welfare of workers in their supply chain, and initiated an investigation into the reported unacceptable working conditions at two of their suppliers' facilities.

Is SHEIN Truly « World-Class »?

A world-class operations company is an organization that exceeds expectations in overseeing and optimizing its operational forms and frameworks to realize remarkable execution and provide high-quality items or administrations. These companies are known for their effectiveness, adequacy, and capacity to reliably meet or surpass client desires. As mentioned earlier, there are some fields in which SHEIN excels in comparison to its’ competitors regarding supply chain optimization and framework implementation. Strategic variables such as cost, time, variety, and quality are all factors that define whether a company can be named a “world-class” operation. As explained during the course, to be a “world-class” organization, one must look at the number of implemented practices of operational excellence to reach higher overall performance. These are the characteristics of a “world-class” operations organization, which we will briefly discuss:

- A clear and consistent strategy;

- A clear choice of practices;

- Synthesis and research on these practices which is aligned with their strategic objectives;

- Implement a culture of continuous improvement (innovation).

Clear and Consistent Strategy

As mentioned earlier, operational excellence and the use of technology have contributed to SHEIN's success. It is important to assess whether a company has a clear and consistent strategy. SHEIN's strategy is characterized by a focus on fast fashion, affordability, and a wide range of products. The company's goal is to provide trendy, affordable clothing and accessories to its global customer base. SHEIN brings new products to market quickly by closely monitoring fashion trends, maintaining an agile supply chain, and implementing efficient production and distribution processes. Their focus on regular inventory rotation and regular product updates allows them to serve different market segments and to respond quickly to customer demands.

SHEIN's focus on speed and cost optimization may conflict with priorities like product quality and sustainability. Fast fashion raises concerns about ethics and sustainability. Critics argue that low prices and rapid production can compromise quality and responsible practices. SHEIN heavily relies on e-commerce and digital technology to enhance efficiency and reach global customers. They utilize AI and data analytics to optimize supply chains, personalize experiences, and offer diverse products based on customer preferences.

Clear Choice of Practices

Based on our research, SHEIN has clear practices that fit into the fast fashion business model and operating strategy. The company emphasizes efficiency, cost-effectiveness, and rapid product turnaround to meet the needs of its target market. As mentioned before, these are some key practices in which they excel: (i) time, (ii) cost and (iii) variety. Based on our research and SHEIN’s public information on their self-positioning, we can conclude that their syntheses and research is strictly aligned with their currently implemented strategies. More information can be found in Chapter 3.

Culture of Continuous Improvement and Innovation

Embracing and operating in the fast fashion industry automatically requires an organization like SHEIN to constantly improve and innovate. Although our team could not find anything concrete and defining regarding their specific agile innovation way, we suppose that SHEIN implements a multidisciplinary organization style where different representatives from different departments meet regularly to innovate in a timely manner and follow the fast fashion industry. During the Vlerick Innovation Management course, we were introduced to this way of innovation, while operating in a SCRUM-friendly environment. This, in our minds, would also be a preferred innovation and improvement strategy.

A corporate culture that emphasizes continuous improvement and innovation is characterized by the ability to respond quickly to market changes. SHEIN has demonstrated agility in the supply chain and quick response to fashion trends. By carefully observing customer tastes and fashion trends, SHEIN can identify new styles and rapidly produce and launch new products. This responsiveness demonstrates a culture that values innovation and adapts to customer needs. As mentioned earlier, SHEIN embraces technology trends for continuous improvement and efficiency. They heavily rely on digital technology like automation, data analytics, AI, and IoT. These technologies enhance inventory management, supply chain optimization, and personalized customer experiences. Technology enables SHEIN to analyze customer behavior, predict trends, improve efficiency, and drive innovation.

Conclusion

What do you do once you are the market leader in online clothing stores?

Financially, SHEIN is preparing for an IPO in 2025. And while its board is optimistic over the increases in revenue, not all analysts are as positive.

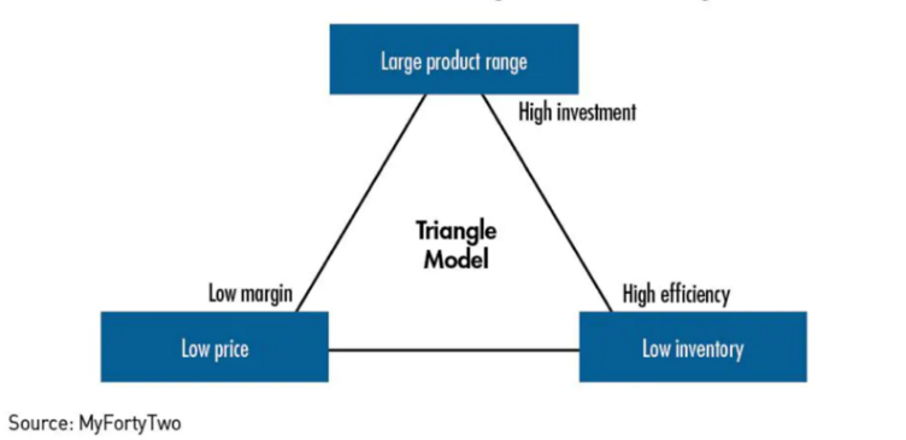

Whatever the future holds for SHEIN, one thing is clear. SHEIN is a “world-class operations company” and has achieved an almost perfect combination of what it takes to achieve internet dominance, and what it takes to achieve a superior lean and flexible operation and supply management. SHEIN has done what few thought possible, which is to be both cheap, fast and have an (infinite) variety.

References

1. H&M. The H&M group – the first 70 years. https://about.hm.com/content/dam/hmgroup/groupsite/documents/en/Digital%20Annual%20Report/2017/Annual%20Report%202017%20Our%20history.pdf (2017).

2. Prrimark. Who we are. https://corporate.primark.com/en-gb/a/about-us/who-we-are (2023).

3. The Guardian. Chris Xu: Who is Shein’s mysterious billionaire founder? | Retail industry |. The Guardian https://www.theguardian.com/business/2022/jul/30/chris-xu-shein-mysterious-billionaire-founder-fast-fashion (2022).

4. Charlie Liu. Everything You Need To Know About SHEIN - Part 1. https://fintechnize.substack.com/p/everything-need-to-know-about-shein (2023).

5. Ethically Dressed. 30+ Businesses Shein Stole Designs From: The Complete List - Ethically Dressed. https://ethically-dressed.com/30-businesses-SHEIN-stole-designs-from-the-complete-list/ (2023).

6. Firstpost. Is-chinas-fast-fashion-giant-shein-guilty-of-using-uyghur-forced-labour. Firstpost https://www.firstpost.com/explainers/is-chinas-fast-fashion-giant-SHEIN-guilty-of-using-uyghur-forced-labour-12536222.html (2023).

7. Hendelmann, V. Dissecting The Shein Business Model: How Does The Firm Make Money? Productmint https://productmint.com/shein-business-model-how-does-shein-make-money/ (2023).

8. Gupta, P. Fashion brands - forget COGS. Inventory is killing your profitability. https://www.linkedin.com/pulse/fashion-brands-forget-cogs-inventory-killing-your-pawan-gupta/ (2021).

9. Economist. Shein exemplifies a new style of Chinese multinational - Marcellus. The Economist https://marcellus.in/story/Shein-exemplifies-a-new-style-of-chinese-multinational/# (2017).

10. Krsmanovic, I. Zara – a quick change inventory . Englit https://englit.net/zara-a-quick-change-inventory/ (2021).

11. SwiftERM. The Secret Of Zara’s Success - Customer Creation. https://swifterm.com/the-secret-of-zaras-success-customer-creation/ (2021).

12. CKGSB. Time to SHEIN. https://english.ckgsb.edu.cn/knowledges/time-to-shein/ (2021).

13. Fish, I. Inside Shein: exclusive interview with Chinese fast fashion giant. Drapers https://www.drapersonline.com/insight/inside-Shein-exclusive-interview-with-chinese-fast-fashion-giant (2022).

14. Leaver, K. Shein’s playbook to supply chain domination. TechnInAsia https://www.techinasia.com/shein-supply-chain-domination (2023).

15. Emmanuel Pineda, M. The Business Strategy of Shein: Reasons for Its Success - Profolus. Profolus https://www.profolus.com/topics/the-business-strategy-of-shein-reasons-for-its-success/?utm_content=cmp-true (2022).

16. Li, J. How the Chinese Fast Fashion Brand Shein is Conquering the US Market - Euromonitor.com. Euromonitor International https://www.euromonitor.com/article/how-the-chinese-fast-fashion-brand-shein-is-conquering-the-us-market (2021).

17. SHEIN Group. SHEIN Leverages Digital Thermal Transfer Printing Technology to Support Small-Batch Production and Reduce Water Use. https://sheingroup.com/corporate-news/Shein-leverages-digital-thermal-transfer-printing-technology-to-support-small-batch-production-and-reduce-water-use/ (2022).

18. Buechel, A. Inside Shein’s Revolutionary Fast-Fashion Business Model . McMillanDoolittle - Transforming Retail https://www.mcmillandoolittle.com/inside-Sheins-revolutionary-fast-fashion-business-model/ (2022).

19. PSFK. Shein’s consumer to manufacturer ai program matches local demand at scale. https://www.google.com/search?sxsrf=APwXEdeR4SPjTxWu-1XQ9gpTMW-DBu7Xgw:1686509029356&q=Shein%27s-consumer-to-manufacturer-ai-program-matches-local-demand-at-scale&spell=1&sa=X&ved=2ahUKEwirsOvc77v_AhVRXaQEHekyC_YQBSgAegQIDRAB&biw=1263&bih=1280&dpr=2 (2022).

20. United Nations. Net Zero Coalition. https://www.un.org/en/climatechange/net-zero-coalition (2022).

21. Caldwell AT, J. & D. Johnson AT, A. D. Shein Is the World’s Most Popular Fashion Brand—at a Huge Cost to Us All. Time https://time.com/6247732/Shein-climate-change-labor-fashion/ (2023).

22. Tan, C. SHEIN plans to cut emissions by 25% by 2030 . Marketing-Interactive https://www.marketing-interactive.com/shein-plans-to-cut-emissions-by-25-by-2030 (2022).

23. SHEIN Group. SHEIN Supplier Code of Conduct. SHEIN USA https://us.shein.com/Supplier-Code-of-Conduct-a-1096.html (2023).

24. Kollbrunner, T. Toiling away for Shein. https://stories.publiceye.ch/en/shein/ (2021).

25. The Guardian. Shein admits working hour breaches and pledges £12m to improve sites. Retail Industry https://www.theguardian.com/business/2022/dec/05/shein-admits-working-hour-breaches-and-pledges-12m-to-improve-sites (2022).

26. Talenox Thoughts. Inside SHEIN’s Strategy: Why H&M and ZARA are losing to the newcomer. https://blog.talenox.com/shein-business-strategy-hm-zara/ (2022).

27. Mileva, G. Top Fashion eCommerce Stats, Facts & Trends. Influencer Marketing Hub https://influencermarketinghub.com/fashion-ecommerce-stats/ (2023).

28. Neerman, P. Shein opens EMEA headquarters and 30 pop-up shops. RetailDetail EU https://www.retaildetail.eu/news/fashion/shein-opens-emea-headquarters-and-30-pop-up-shops/ (2023).

29. Financial Times. Shein gives investors lofty revenue projections as it prepares for IPO. https://www.ft.com/content/9709f1b8-a8b8-4210-bdd8-784a3025758d (2023).