EU–China Trade Tensions in Focus as EVs and Dairy Take Centre Stage

Brussels Motor Show 2026: Commercial Showcase Amid Policy Headwinds

The Brussels Motor Show 2026 offered a high-profile setting for evolving EU–China trade relations, drawing 64 automotive brands — including 13 Chinese manufacturers such as BAIC, BYD, NIO, Xpeng, and MG (owned by SAIC). Several of these companies showcased new models tailored for European consumers, underscoring China’s expanding commercial ambitions in the European market. However, the event also unfolded against a backdrop of ongoing trade tensions, particularly involving electric vehicles (EVs) and agricultural goods.

EU Tariffs on Chinese Electric Vehicles

The European Union has taken a firm stance on electric vehicles from China following concerns that state subsidies were giving Chinese manufacturers an unfair competitive edge. After a lengthy anti-subsidy investigation, Brussels imposed countervailing duties as high as 35.3 % on Chinese battery electric vehicles in October 2025. These duties are intended to address alleged market distortions and protect the EU’s automotive industry from a surge of low-priced imports.

The measures have been contentious: while they aim to defend EU industry, they have also complicated Sino-European economic engagement as Chinese brands gain traction in European markets.

China Responds with Tariffs on EU Dairy Products

In turn, China announced tariffs ranging from 21.9 % to 42.7 % on selected EU dairy products, effective December 23, 2025, following its own anti-subsidy investigation begun in August 2024. The duties target products including milk, cream and several cheeses such as Roquefort.

China’s Ministry of Commerce said EU subsidies had caused “substantial damage” to domestic producers, while the EU rejected Beijing’s findings as baseless and confirmed it would pursue further dialogue with Chinese authorities. These dairy tariffs add to a series of reciprocal trade measures, highlighting how both sides are increasingly using trade defence tools in response to one another’s policies.

EU Commission Guidance on Minimum Pricing for Chinese EVs

Shortly after these developments, on January 12, 2026, the European Commission published guidance outlining how Chinese EV exporters could submit price undertaking offers as an alternative to tariffs. Under the framework, any minimum-price proposal must:

- remove the injurious effects of subsidies;

- have an effect comparable to that of duties;

- be practicable and measurable;

- and include information on sales channels, sales and safeguards against cross-compensation.

The Commission will also consider factors such as future investments in the EU as part of its evaluation. These price undertakings represent a shift toward negotiated mechanisms that allow market access under conditions that address subsidy concerns, rather than relying solely on rigid tariff barriers. Both Brussels and Beijing have signalled willingness to engage in such dialogue, though details of implementation remain subject to further negotiation.

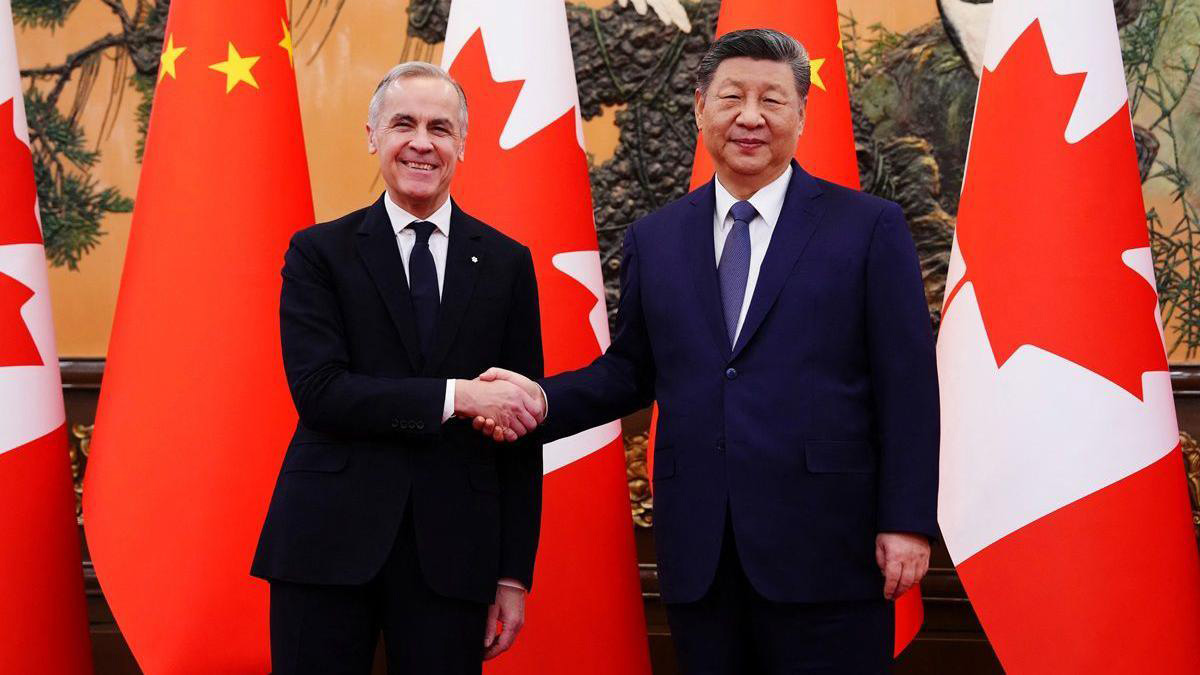

Canada–China Trade Engagement: A Parallel Example

In mid-January 2026, Canada and China took a notable step toward improving bilateral trade relations that illustrates how tariff policy on EVs can be used strategically to unlock concessions in other sectors. During the first Canadian prime ministerial visit to Beijing in eight years, Prime Minister Mark Carney announced a preliminary deal under which:

- Canada would reduce its tariff on Chinese EVs from 100 % to 6.1 %, with an initial quota of up to 49,000 vehicles annually (rising to 70,000 over five years).

- In exchange, China agreed to significantly lower tariffs on Canadian agricultural exports, particularly canola seeds — from around 84 % to approximately 15 % — along with reductions on other farm products.

Carney characterised the agreement as a sign that relations with China were becoming more predictable and economically constructive. This arrangement contrasts with both the EU and U.S. approaches, showing how negotiating EV tariff relief can be paired with expanded market access for agricultural exports and broader economic cooperation.

Conclusion: Complex Interplay of Tariffs, Dialogue and Market Strategy

Taken together, these developments illustrate a multi-layered trade relationship between China, the EU and other partners:

- The EU’s duties on Chinese EVs reflect industrial protection priorities amid rapid market changes.

- China’s dairy tariffs underscore the reciprocal use of trade remedies in key sectors.

- The Canada–China example shows how tariff adjustments on EVs can be part of broader trade-off negotiations, linking automotive and agricultural interests.

- The EU’s minimum-price guidance indicates a willingness to explore negotiated alternatives that preserve market access while addressing subsidy concerns.

For businesses operating across these markets, the evolving landscape highlights the importance of regulatory strategy, proactive engagement with policymakers, and diversified market positioning as trade policy, industrial interests and geopolitical considerations intersect more closely in global economic relations.