A Year Since the Implementation of the New Company Law: Observations, Practice, and Takeaways

On July 1, 2024, the newly revised Company Law of the People's Republic of China officially came into effect, marking its first anniversary recently. As a key piece of legislation underpinning the rule of law in the market economy, the new Company Law has brought about a series of profound changes in areas such as optimizing corporate governance structures, balancing shareholder rights and interests, and improving the capital system. On this anniversary, we draw upon practical experience to review the latest developments in the application of the law over the past year, focusing on “corporate governance” and “capital adequacy.” By reviewing changes in certain registration procedures in practice, we briefly summarize the new trends in the application of the law over the past year and extract forward-looking institutional insights for foreign-invested enterprises.

- Corporate Governance

- Changes in the Appointment of Supervisors

According to Articles 76, 69, and 83 of the new Company Law, the requirements regarding the appointment of supervisors have been updated as follows:

| Company Size | Supervisor Requirements |

For companies with a supervisory board of three or more members | 1/3 of the supervisors shall be employee supervisor(s) elected through a democratic process |

Where there are fewer shareholders | One supervisor |

Where there are fewer shareholders and unanimous consent is obtained | No supervisor |

Establishment of an audit committee composed of directors | No supervisor (or supervisory board) |

There are several issues that require special attention.

- Requirements and Election Procedures for Employee Supervisors

- Eligibility Requirements

According to Article 2, Item (2) of the Opinions of the China General Trade Unions on Strengthening the System of Employee Directors and Employee Supervisors in Incorporated Enterprises (General Trade Union Issuance [2016] No. 33), candidates for employee supervisors must have an employment relationship with the company. Senior management personnel and supervisors may not concurrently serve as employee directors. Similarly, senior management personnel and directors may not concurrently serve as employee supervisors. Immediate family members of senior management are not recommended to serve (or concurrently serve) as employee directors or employee supervisors.

- Election Procedures

According to Article 2 and Article 4 of the Guidelines for the Operation of Employee Representative Congresses (Guo Chang Kai Zu Ban Fa [2022] No. 2), the election of employee supervisors should be conducted by secret ballot. A resolution is passed only if it receives approval from more than half of all employee representatives.

- Changes in the Appointment of Directors

According to Articles 68 and 75 of the new Company Law, the requirements regarding the appointment of directors have been updated as follows:

| Company Size | Director Requirements |

Limited liability companies with a board of directors comprising three or more members | Employee directors may be included among the board members |

Limited liability companies with 300 or more employees | At least one employee director must be included among the board members |

Limited liability companies of smaller scale or with fewer shareholders | The board of directors may be omitted, and a sole director may be appointed |

For limited liability companies with 300 or more employees, if they do not wish to appoint an employee supervisor or employee director, they may consider keeping the number of employees below 300. If, due to business needs, it is not possible to limit the number of employees to under 300, then the appointment of an employee supervisor or employee director should be considered.

Therefore, in practice, for WFOEs with only one shareholder, it is often preferable to abolish the board of directors and appoint a sole director.

In addition, the eligibility requirements and election procedures for employee directors are similar to those for employee supervisors. When registering with the local Administration for Market Regulation, documents evidencing democratic procedures, such as the resolution of the employee representative congress, must be submitted.

- Duties of Directors, Supervisors, and Senior Management under the New Company Law

Under the new Company Law, the duties of directors, supervisors, and senior management (collectively, “DSS”) can be categorized into two main types: the duty of loyalty and the duty of diligence. The duty of loyalty focuses on preventing DSS from seeking personal gain, avoiding any conduct that may result in conflicts of interest, and preventing DSS from transferring company interests to themselves or related parties. If the duty of loyalty is breached, the company may recover all undue gains obtained by the DSS and may also seek punitive damages.

The duty of diligence requires DSS to exercise reasonable care in the performance of their duties, demonstrating the necessary attention, skill, and responsibility, and always prioritizing the best interests of the company.

- Duty of Loyalty

The duty of loyalty for DSS is primarily stipulated in Articles 181 to 184 of the new Company Law. Article 181 sets out absolutely prohibited conduct, namely, actions that are strictly forbidden under any circumstances. In contrast, Article 182 to 184 stipulates conducts (Article 182 to 184 Conducts) may be permitted if statutory procedures are followed (i.e., reporting conflicts of interest to the board of directors or the shareholders’ meeting, and obtaining approval through board or shareholder resolutions as required by the articles of association). Article 182 to 184 Conducts include entering into contracts or transactions with the company directly or indirectly, taking advantage of their position to seize corporate business opportunities for themselves or others, and engaging in businesses similar to that of the company for their own benefit or on behalf of others.

In addition, with the implementation of the Twelfth Amendment to the Criminal Law of the People’s Republic of China, the scope of certain traditional corruption-related offenses has gradually been extended to cover ordinary enterprises. Therefore, directors, supervisors, and senior management should pay particular attention to the potential criminal risks that may arise from breaches of the duty of loyalty.

For example, common criminal offenses corresponding to the absolutely prohibited conduct include embezzlement, misappropriation of funds, acceptance of bribes, and infringement of trade secrets. As for Article 182 Conducts, common corresponding offenses include illegal operation of competing businesses, illegally seeking benefits for relatives or friends, malpractice resulting in the undervalued conversion or sale of company assets, and the improper sale of company or enterprise assets.

- Duty of Diligence

The duty of diligence mainly comprises four aspects: the obligation of corporate governance (including review of board resolutions under Article 125(2) and the duty to respond to inquiries under Article 79(1) and Article 187); the obligation of maintaining capital adequacy (Articles 51(1), 53, 163, 211, and 226); the obligation of company liquidation (Articles 232(2) and (3), and Article 238); and the obligation to safeguard shareholders’ right to information (Article 12 of the Judicial Interpretation (IV) of the Company Law).

- Scope of DSS Liabilities

The following table summarizes the liability for damages of directors, supervisors, and senior management under the new Company Law.

| Actions | Responsible Parties | Form of Liability | |

|---|---|---|---|

| Liability to the company | Damaging company interests through related-party transactions (Article 22) | DSS | Liability for compensation |

Verifying and urging shareholders’ actual payment of capital contributions and increases (Article 51) | Directors | Liability for compensation | |

Withdrawal of capital contributions (Article 53) | DSS | Joint and several liability for compensation | |

Illegally providing financial assistance (Article 163) | DSS | Liability for compensation | |

Performing duties in violation of laws, administrative regulations, or the company’s articles of association, resulting in losses to the company (Article 188) | DSS | Liability for compensation | |

Engaging in conduct detrimental to the interests of the company or its shareholders (Article 192) | Directors (including shadow directors), Senior Management | Joint and several liability | |

Illegal distribution of profits (Article 211) | DSS | Liability for compensation | |

Illegal reduction of registered capital (Article 226) | DSS | Liability for compensation | |

Failure to fulfill liquidation obligations (Article 232) | Directors | Liability for compensation | |

| Liability to shareholders | Violating laws, administrative regulations, or the articles of association, thereby harming shareholder interests (Article 190) | Directors and Senior Management | Shareholder lawsuit |

| Liability to third parties | Causing damage to others by willful misconduct or gross negligence in the performance of duties (Article 191) | Directors and Senior Management | Liability for compensation |

Failure to fulfill liquidation obligations (Article 232) | Directors | Liability for compensation |

- Capital Adequacy

- Key Considerations in Capital Reduction

In practice, when a company intends to reduce its registered capital for business purposes, it must carefully assess the potential impact of such reduction on the company’s various qualifications and licenses.

For example, in the establishment of a company, the investors, considering corporate branding, prefer to apply for a company name that does not include an administrative region, opting instead for the format "XX (China) Co., Ltd." To comply with regulatory requirements, the company set its initial registered capital at RMB 50 million. Under such circumstances, if this company wishes to reduce its capital but cannot meet the new regulatory requirements, namely Article 19 of the Measures for the Implementation of the Regulations on the Administration of Enterprise Name Registration (2023 Revision) (SAMR Order No. 82), the company name may no longer include the word "China."

- Proper Use of Statutory Reserves

- How should the original three funds (reserve fund, employee incentive and welfare fund, and enterprise development fund) be handled from an accounting perspective?

According to Article 53(1) of the new Company Law, after the company is established, shareholders must not withdraw their capital contributions. In practice, it is rare for foreign-invested enterprises to intentionally and directly withdraw capital contributions; more often, such behavior results inadvertently from a misunderstanding of compliance requirements, causing certain business activities to unintentionally constitute withdrawal of capital.

A common issue is the improper use of the company’s statutory reserves.

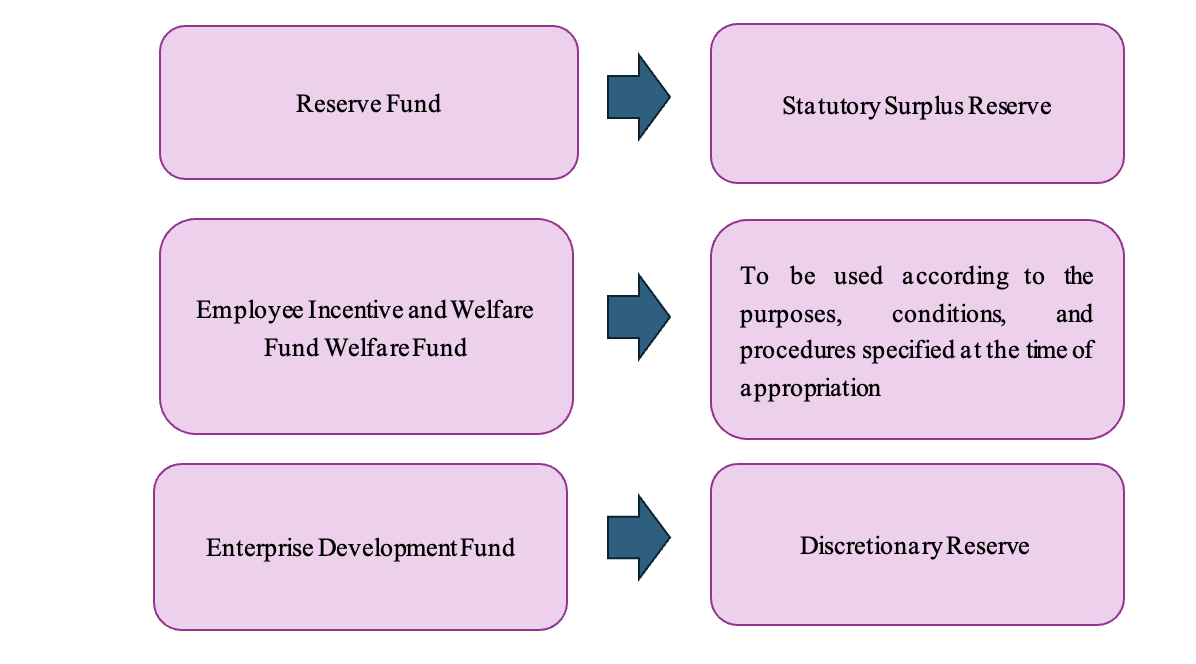

Many foreign-invested enterprises have, in accordance with the (now repealed) Sino-Foreign Equity Joint Venture Law, lawfully set aside a reserve fund, an employee incentive and welfare fund, and an enterprise development fund. Following the implementation of the new Company Law, and in accordance with the Notice on Certain Financial Treatment Issues Following the Implementation of the Company Law and the Foreign Investment Law (Cai Zi [2025] No. 101), the original three funds should be handled as follows:

- What are the specific requirements for using reserves to offset losses?

According to the Notice on Certain Financial Treatment Issues Following the Implementation of the Company Law and the Foreign Investment Law (Cai Zi [2025] No. 101), when a company uses its reserves to offset losses pursuant to Article 214 of the Company Law, it should base the offset on its most recent audited annual individual financial statements (no earlier than the 2024 fiscal year). The accumulated deficit at the end of the period may be offset up to zero, and the order of offset should be discretionary surplus reserves first, followed by statutory surplus reserves.

From a procedural perspective, when a company uses its reserves to offset losses, it must formulate a loss-recovery plan, detailing the circumstances of the loss, the reasons for offsetting the loss, the source, amount, and method of the reserves to be used. This plan should be approved by a resolution of the board of directors and submitted to the shareholders’ meeting (or a similar authority, hereinafter referred to as the shareholders’ meeting) for consideration.

- Changes in Registration Procedures

- Beneficial Ownership Information Filing

This filing requirement was introduced by the State Administration of Market Regulation and the People’s Bank of China for anti-money laundering and other purposes. The filing must be completed by November 1, 2025.

Subsidiaries of foreign companies are required to report their beneficial owners.

For ordinary companies, if the following conditions are met, there is no need to declare beneficial owners. However, it is still necessary to check the commitment letter in the system:

- The registered capital (or capital contribution) does not exceed RMB 10 million (or its equivalent in foreign currency);

- All shareholders or partners are natural persons;

- There are no natural persons, other than shareholders or partners, who actually control or benefit from the company;

- There are no circumstances where control or benefit is exercised through means other than shareholding or partnership interests.

- Pay Attention to New Registration Practices in Certain Regions

In recent years, in response to the trend of “improving the business environment,” market regulatory authorities in many regions have actively explored the simplification of registration and filing procedures. For example, in the Pudong New Area, according to Article 6 of the Several Provisions on the Registration Confirmation System for Market Entities in Shanghai Pudong New Area, entities are only required to register their principal business activities, licensed projects, and projects subject to special foreign investment access management. If an entity engages in non-licensed business activities beyond its registered scope, the registration authority will not impose penalties.

For the record, although the trend is toward loosening regulations on companies’ daily operations, legal requirements such as resolutions and decisions must still be properly documented by the company for compliance purposes and in preparation for potential random inspections.

Source:

Huiye Law Firm